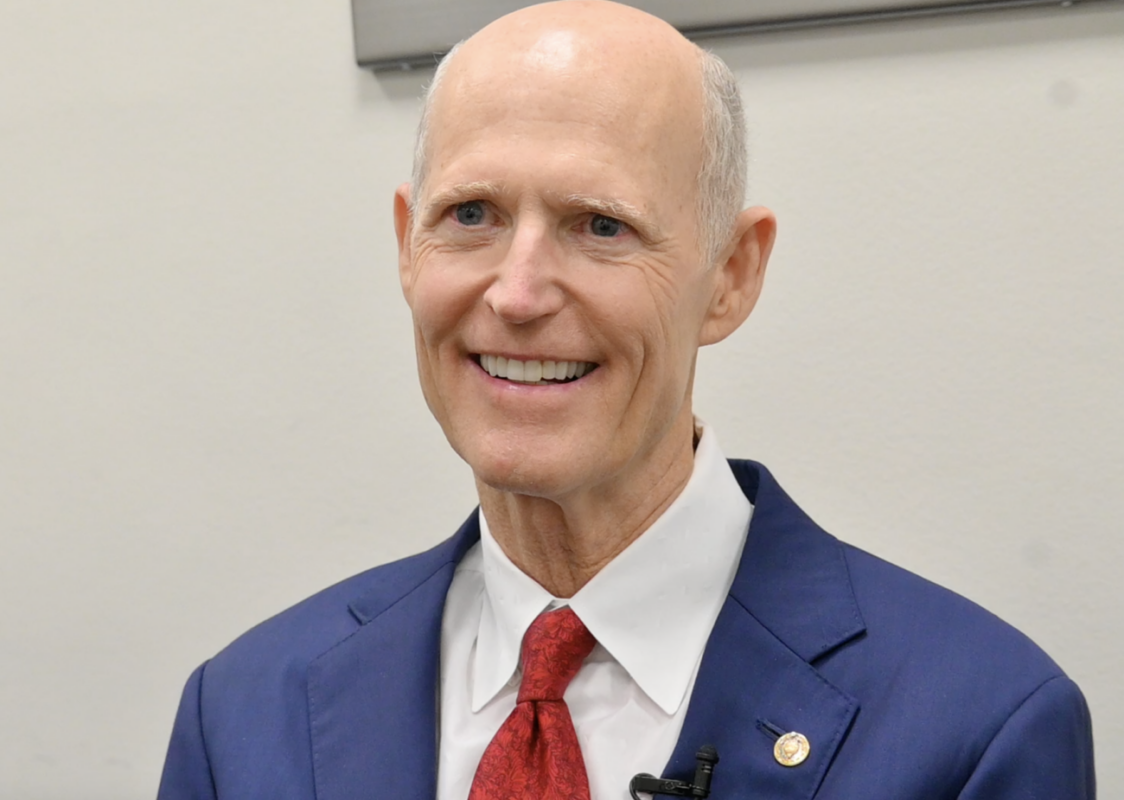

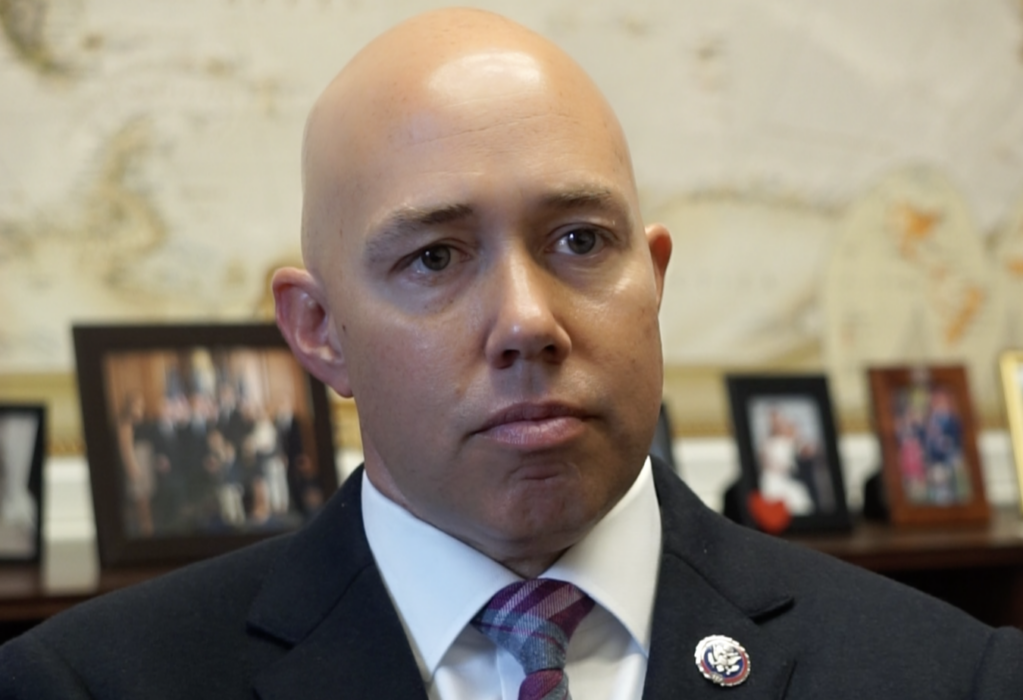

The Federal Disaster Tax Relief Act of 2023, led by Senator Rick Scott (R-FL) and Representative Greg Steube (R-FL), has been signed into law by President Joe Biden.

The new law, which was historically passed in the House of Representatives via discharge petition, will provide tax relief for certain federal disasters.

A discharge petition is a legislative mechanism that, if supported by a majority of the House, calls for a floor vote on a bill without passing it through committees.

Senator Scott and Representative Steube celebrated the bill’s enactment.

“My Federal Disaster Tax Relief Act becoming law will finally start getting families in Florida, Puerto Rico and folks across the nation the tax relief they need and deserve after suffering losses from these devastating storms,” said Scott.

Similarly, Steube emphasized how Floridians will now be able to “claim tax deductions for hurricane expenses and other federally declared disasters.”

The Federal Disaster Tax Relief Act would prevent Americans who suffered losses due to federally designated natural disasters from paying taxes on federal aid received to recover from the same.

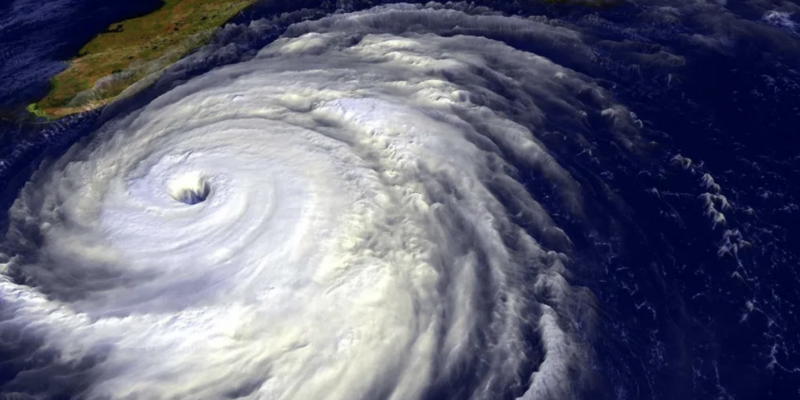

Such natural disasters include Hurricanes Ian, Idalia, Nicole, Fiona, Debby, Helene, and Milton.

The act would also allow Americans who faced losses from eligible disasters to claim such losses without itemizing such deductions for tax purposes.

Moreover, such losses would not have to exceed 10% of a claimant’s adjusted gross income, as is currently the case, to qualify.

Florida lawmakers had been persistently lobbying for expanded federal assistance in response to years of record-breaking hurricane-related damages.

In 2024, Florida experienced three hurricanes in just 3 months, causing billions of dollars in damages.

According to accuweather estimates, 2024 hurricanes caused roughly $500 billion in damages from immediate destruction and long-term and residual impacts.