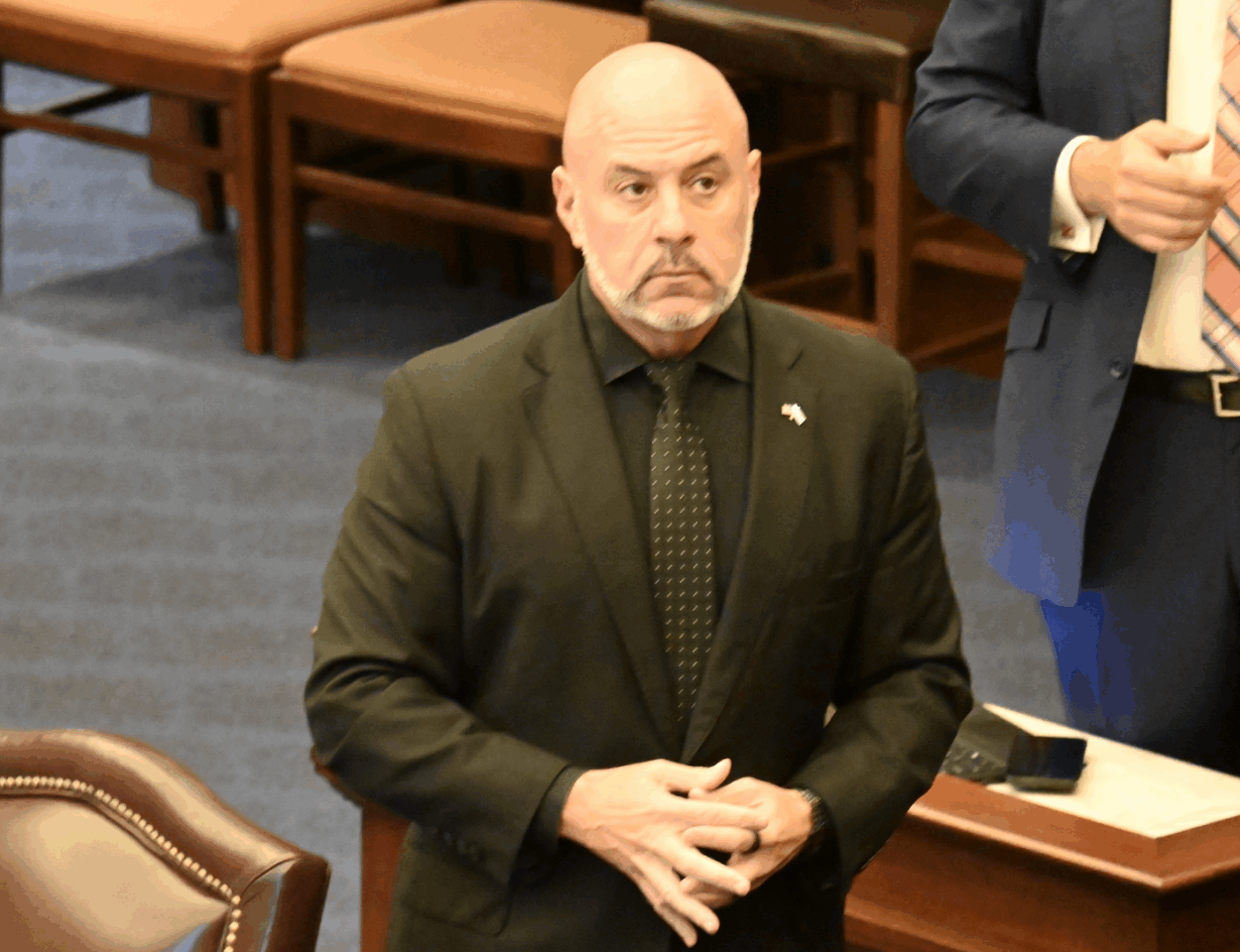

Representative Jimmy Patronis (R-FL) announced in a recent statement that he will join the House Committee on Small Business and that he is "honored" by the appointment.

Additionally, Rep. Patronis will sit on the following subcommittees of the Small Business Committee: Rural Development, Energy and Supply Chains, Innovation, Entrepreneurship, and Workforce Development, and Oversight, Investigations, and Regulations.

"I'm honored to be appointed to the House Committee on Small Business and look forward to being a strong voice for hardworking Floridians and small businesses that form the backbone of America's economy," said Rep. Patronis in his press release, adding, "More than 33 million small businesses in the United States account for more than 43% of the nation's total GDP."

The newly minted Florida Congressman further noted that the Sunshine State boasts 3 million small businesses, which make up more than 99% of Florida's companies.

"My thanks to Speaker Mike Johnson, Majority Leader Steve Scalise, Majority Whip Tom Emmer, and Small Business Committee Chairman Roger Williams for the opportunity to help craft and support policies that will foster fiscal responsibility, cut red tape, and grow an economy that works for everyone," Patronis continued, citing his personal experience working at the famed Captain Anderson's restaurant in Panama City Beach.

"As a former small business owner and working my entire life in the restaurant business, I know how hard it is for small business owners to earn a living and make payroll," he added, concluding, "I'm excited to work with my colleagues on the Committee to protect our small businesses, provide better opportunities to live the American dream, and help President Trump Make America Wealthy Again."

In addition to the Small Business Committee role, Patronis announced earlier in April that he will serve on the House Transportation and Infrastructure Committee.

Meanwhile, Representative Greg Steube (R-FL) recently introduced legislation protecting small businesses from undue tax burdens through gift and estate taxes levied by the Internal Revenue Service (IRS) after the 2010 PATH Act prohibited taxation on charitable donations.