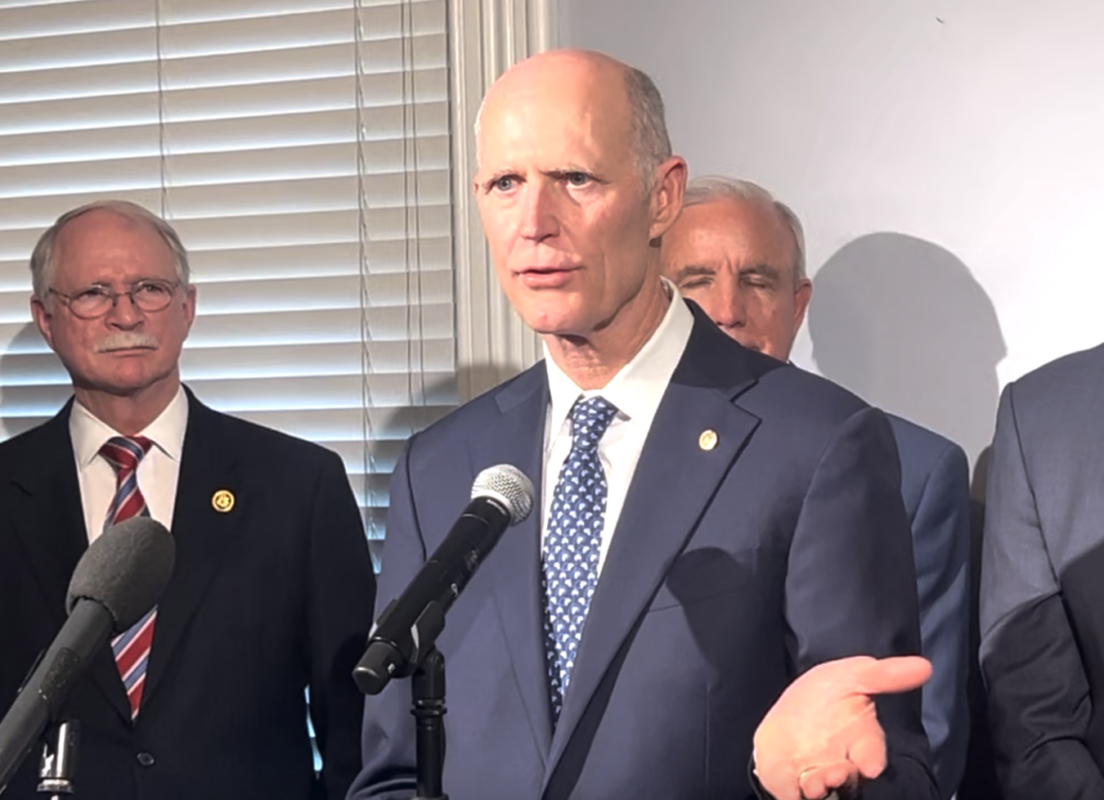

US Senators Rick Scott (R-FL) and Elizabeth Warren (D-MA) are pushing back against the Federal Reserve’s recently published enforcement policy for rules on illicit trading by Federal Reserve Bank officials.

The Fed has been conducting a years-long review of its rules after various top Fed officials were forced to resign due to questionable trading practices.

However, Senators Scott and Warren have rejected the new rules, claiming they are insufficient and create novel loopholes for Fed officials to profit off their knowledge of Fed decisions.

The Senators sent a letter to Fed Chair Jerome Powell criticizing the new rules and requested they be repealed and replaced.

“The Gaps in this policy render effective enforcement of Fed trading rules impossible, and indicate that, once again, you do not appear to be willing to act in order to prevent future scandals,” the letter said.

The crisis that sparked the current Fed rule change occurred in 2020, during the COVID pandemic.

During that time, Fed officials traded individual stocks and investments anticipating Fed policy changes in response to the crisis.

Ultimately, none of the individuals involved were held responsible for their actions, although six top Fed officials resigned in the wake of the scandal.

The Senators’ letter alleges the new enforcement rules are ineffective due to a lack of specific penalties for rule violations, ambiguous language, and for creating loopholes.

The letter called the new enforcement policy “a farce: it will do more to aid and abet the coverups of Fed trading scandals than it will do to reveal and eliminate them.”

The Fed has yet to respond to the letter.