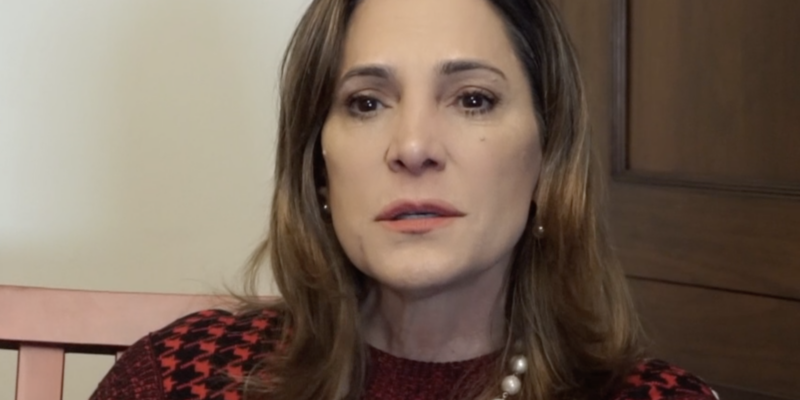

Florida Rep. Maria Elvira Salazar (R) has introduced a bill urging the U.S. Senate to ratify the Chilean Tax Treaty. The bipartisan bill, introduced with Virginia Rep. Gerry Connolly (D) and Texas Rep. Joaquin Castro (D), seeks to protect American investments in Chile from inefficient taxation.

The bipartisan group of lawmakers introduced the bill, arguing that it would strengthen the U.S. economy while also creating new opportunities that would expand economic ties between Chile and Miami. The U.S. and Chile negotiated what would become the Chilean Tax Treaty. It would reduce double taxation while also withholding rates on U.S. investments in Chile that consist with the U.S. Model Tax Treaty.

Salazar praised the treaty, sharing that “as the economic powerhouse of South America, Chile is well known for its strong defense of free markets and private property.” By adopting the treaty, she explained that it would “allow for U.S. - Chile business ties to continue flourishing and bring more prosperity to both Miami and Chile.”

Castro further explained that ratifying the treaty would be a vital effort “to protect the jobs that U.S. - Chile trade and investment create in both countries.” “The United States and Chile have a long record of cooperation on the important issues of our time - from clean energy to health care research,” he added, highlighting that “the Chilean Tax Treaty will support a stronger economic relationship between our nations and demonstrate America’s commitment to one of our most important partners in the Western Hemisphere.”

Chile passed new tax legislation in 2014 that increased their corporate tax rate. Without the ratified bilateral tax treaty, American companies that are operating out of Chile would be subjected to a tax rate of up to 44.45% beginning in 2027. Currently, the treaty is awaiting consideration by the Senate after the Senate Foreign Relations Committee overwhelmingly voted in favor of the treaty by a vote of 20-1 on June 1, 2023.