small businesses

Representative Mike Haridopolos's (R-FL) Greenlighting Growth Act has already passed the House Committee on Financial Services just days after he introduced it. To reiterate, the Greenlighting Growth Act allows businesses that make less than $1.235 billion in annual revenue but have grown via acquisitions to continue filing simplified Securities and Exchange Commission (SEC) reports as […]

Representative Mike Haridopolos (R-FL) is introducing his first piece of legislation, aiming to encourage the growth of small businesses. Specifically, the Greenlighting Growth Act cuts regulations and updates outdated finance reporting laws, addressing an issue arising from the 2012 JOBS Act. The JOBS Act introduced an "Emerging Growth Company" (EGC) category for business taxes, defined […]

Representative Jimmy Patronis (R-FL) announced in a recent statement that he will join the House Committee on Small Business and that he is "honored" by the appointment. Additionally, Rep. Patronis will sit on the following subcommittees of the Small Business Committee: Rural Development, Energy and Supply Chains, Innovation, Entrepreneurship, and Workforce Development, and Oversight, Investigations, […]

Representative Vern Buchanan (R-FL) introduced a bill increasing tax incentives for small businesses, encouraging growth and innovation. The most significant provision of Rep. Buchanan's American Innovation Act is increasing the amount of income small businesses can deduct from federal income taxes from $5,000 to $20,000, a massive tax break. Additionally, startup expenditure deductions, like advertising, […]

Representative Mike Haridopolos (R-FL) recently addressed the House Finance Committee in favor of two pieces of legislation: one holding China accountable for currency manipulation and another protecting small businesses from regulations that impose unnecessary costs. H.R. 692, the China Exchange Rate Transparency Act, requires the U.S. Executive Director at the International Monetary Fund (IMF) to […]

House of Representatives Majority Leader Steve Scalise (R-LA) recently told The Floridian’s Javier Manjarres that Republicans intend to enshrine President Donald Trump’s tax cuts into law. President Trump passed the Tax Cuts and Jobs Act (TCJA), a major tax reform law, in 2017. The TCJA mainly reduces personal income and corporate taxes among other regulatory […]

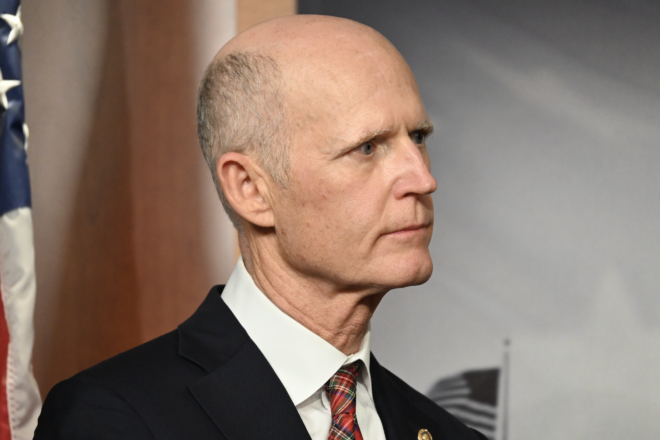

Senator Rick Scott (R-FL) joined 34 Republican senators, including Senate Majority Leader John Thune (R-SD) to introduce the “Main Street Tax Certainty Act” a bill that intends to make the 20 percent pass-through business tax deduction permanent. The legislation would amend the Internal Revenue Code of 1986 to make permanent the deduction for qualified business […]

Small businesses cannot thrive if they are choked with regulations that impede their growth. A bill introduced by Representative Aaron Bean (R-FL) has recently passed the House Small Business Committee, requiring a more democratic regulatory process that allows small businesses to raise their voices before implementing new policies. Named the "Let American Businesses be On […]

Representative Maria Elvira Salazar (R-FL) announced the launch of the Business Growth and Acceleration Program (BizGap) alongside Florida International University (FIU). Rep. Salazar, a member of the Small Business Committee, was able to secure $650,000 to “create jobs and grow small businesses in District 27” according to her press release. Through the funding of the […]

After Hurricane Idalia swept through Florida’s Big Bend region, Governor Ron DeSantis (R-FL) has announced more than $6.4 million for small businesses in the recovery process. The Florida Small Business Emergency Bridge Loan Program – administered by FloridaCommerce – allows entities affected by the major storm to receive short-term, zero-interest loans if they’ve experienced “economic […]

After Hurricane Idalia swept through Florida’s Big Bend region, Governor Ron DeSantis (R-FL) has announced more than $1.6 million for small businesses in the recovery process. The Florida Small Business Emergency Bridge Loan Program – administered by FloridaCommerce – allows entities affected by the major storm to receive short-term, zero-interest loans if they’ve experienced “economic […]

This week, Governor Ron DeSantis (R-FL) activated the Florida small business emergency bridge loan program, which has made $50 million avaliable to small businesses in the state of Florida. The move to activate the program is in response to Hurricane Ian and is available to many South Florida counties. This region of the state that […]

It has been reported around the nation that the Internal Revenue Service (IRS) is going to be hiring a vast number of agents after the House votes on Friday to grant the agency 80 billion dollars in additional funds. 87,000 agents are expected to be hired following the passage of the bill in the House. […]