Chinese ‘fast-fashion’ brand SHEIN is again at loggerheads with US lawmakers following reports the former intends to list on the London Stock Exchange (LSE).

SHEIN had previously attempted to enter the US stock market through an initial public offering (IPO). However, SHEIN halted the operation after the Securities and Exchange Commission (SEC) asked the company to make its IPO application public.

SHEIN achieved its fame and popularity by offering cheap, fashionable, and youthful clothes across the globe.

However, SHEIN’s critics pushed back against the brand entering American public markets due to reports alleging SHEIN lowers prices by working with manufacturers using Uyghur slave labor.

Now, SHEIN is seemingly circumventing American regulators by opting for an IPO in the UK’s stock market.

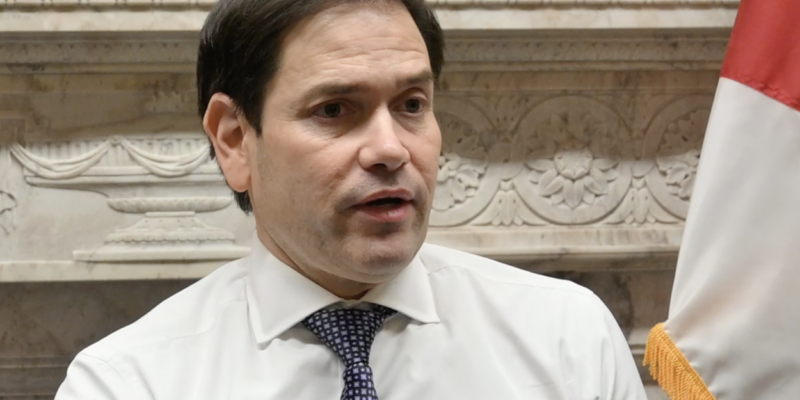

Consequently, US Senator Marco Rubio (R-FL) sent a letter to UK Chancellor of the Exchequer Jeremy Hunt to urge the latter against permitting SHEIN’s UK IPO.

According to Senator Rubio, SHEIN has surreptitiously worked to conceal their connections to the Chinese Communist Party (CCP).

Rubio also claimed SHEIN’s contracts with cotton providers working in Chinese regions plagued by Uyghur slave labor questions the designer’s ethical credibility.

“Slave labor, sweatshops, and trade tricks are the dirty secrets behind SHEIN’s success,” said Rubio as he encouraged the UK to investigate SHEIN prior to granting it an IPO. “I trust you will treat these allegations against SHEIN with the utmost seriousness, investigate them fully, and take appropriate action to protect investors,” concluded Rubio.

UK officials reportedly met earlier in the year with SHEIN executives and spoke favorably about a prospective IPO.

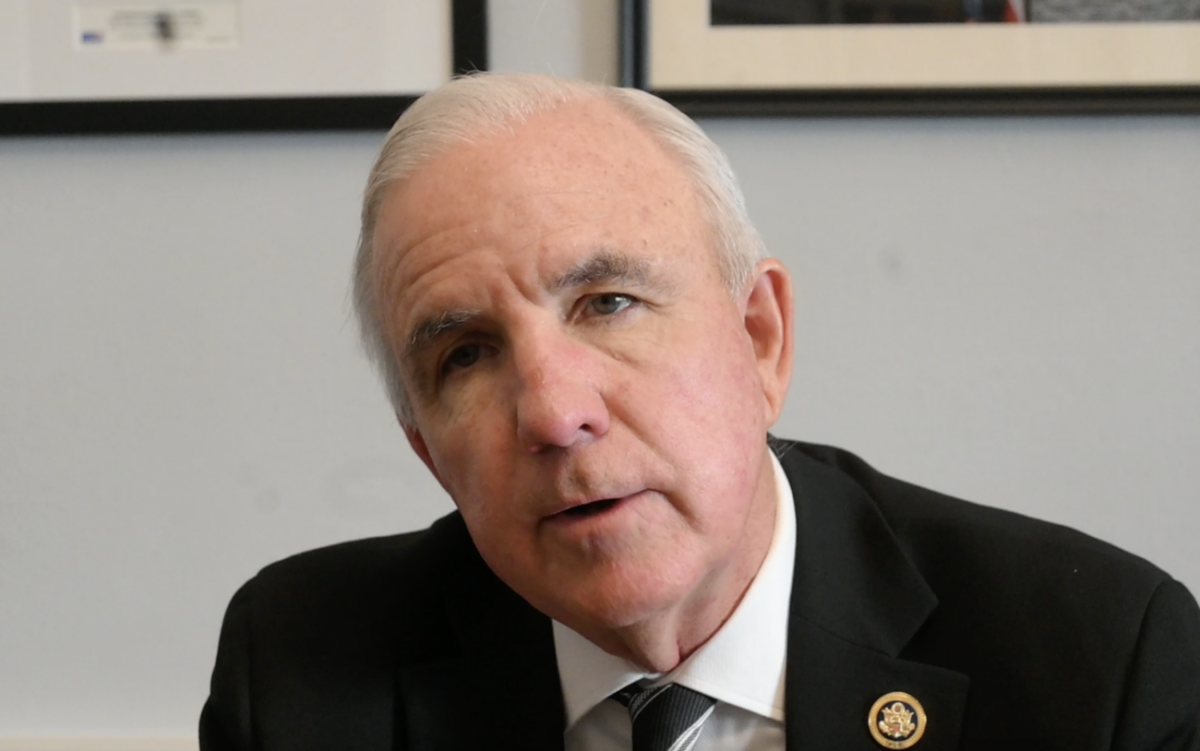

Chancellor Hunt last met with SHEIN Executive Chair Donald Tank last February in an attempt to lure the latter into pursuing a UK IPO.

“We have developed reforms to boost the UK as a destination for IPOs, including making it easier for companies to list more quickly,” a UK Treasury spokesperson said.