Conservative lawmakers have rung in the new year by emphasizing the holidays' financial toll on Americans and the expected continuation of rising costs in 2024.

A study by the Joint Economic Committee (JEC) Republicans recently published reveals an average increase of $10 thousand dollars per US household in inflationary costs.

According to the report, Floridians spent nearly $13 thousand dollars more in 2023 than they did in 2021 solely to shoulder inflation.

While some have credited inflation to COVID-19, supply chain inefficiencies, and international conflict, American conservatives have blamed President Joe Biden as chiefly responsible for the dollar's devaluation.

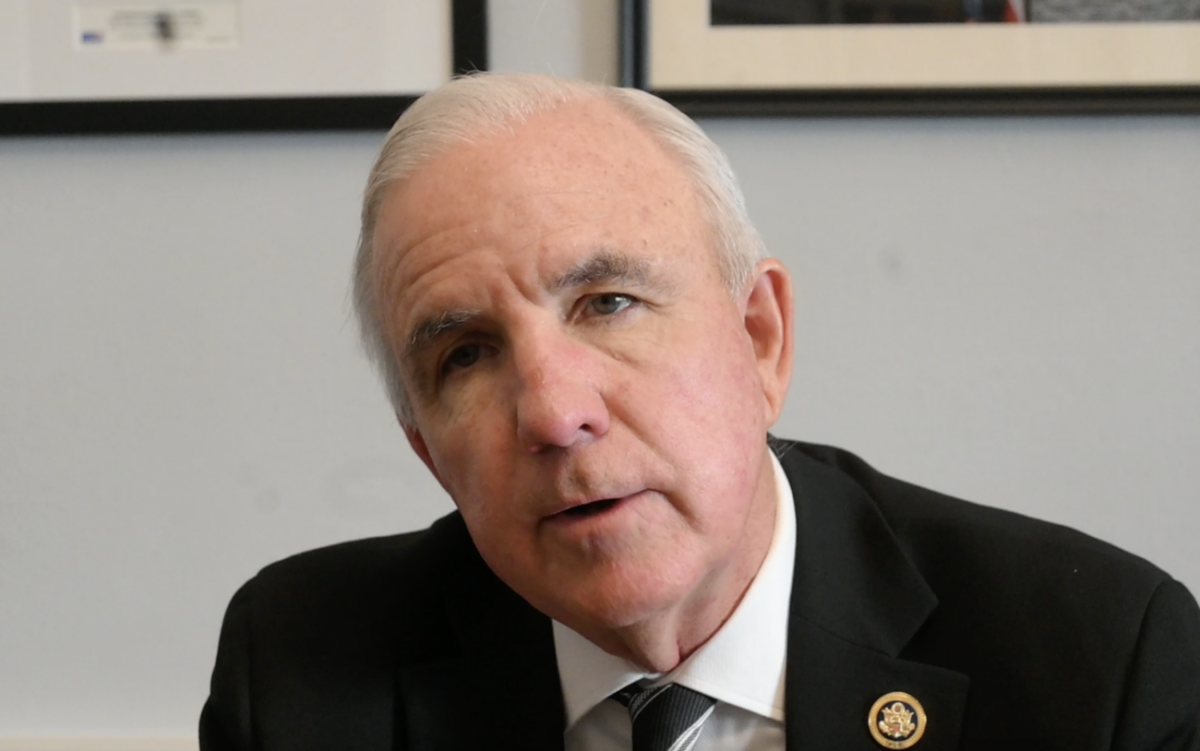

US Senator Rick Scott (R-Fl), for example, has repeatedly claimed President Biden's fiscal policy is impoverishing Americans.

Senator Rick Scott recently released a video explaining how, according to him, Biden's agenda is undermining the US economy and weakening families' purchasing power.

"This holiday season, #Bidenomics is stretching Florida families budgets to the MAX and making the American dream feel out of reach," said Scott via X.

🚨 WATCH: This holiday season, #Bidenomics is stretching Florida families budgets to the MAX and making the American dream feel out of reach.

But it doesn't have to be this way! I'm going to keep fighting to keep big government in check. pic.twitter.com/MhEjhLxrYe

— Rick Scott (@SenRickScott) December 21, 2023

For months, the US Federal Reserve has attempted to lower inflation by raising interest rates. Last July, the Fed. raised its benchmark federal-funds rate to a 22-year high.

However, Fed. officials have reportedly suggested interest rates could be significantly lowered in 2024 due to decreasing inflation in the last months of 2023.

According to the Wall Street Journal (WSJ), San Francisco Fed President Mary Daly expressed her alignment with numerous other Fed officials planning for at least three rate cuts in 2024.

Government data released last week alleges 12-month inflation rates, excluding food and energy costs, could decrease to 3% in 2024.

Given the Fed targets 2% inflation when calculating interest rates and the latter's correlation with the former, reports of decreased inflation could result in lowered interest rates.

On Wall Street, news of the Fed's preparations to lower interest rates have rallied markets.

According to the WSJ, market fears neared several-year lows as investors grew increasingly confident of healthy economic growth in 2024.