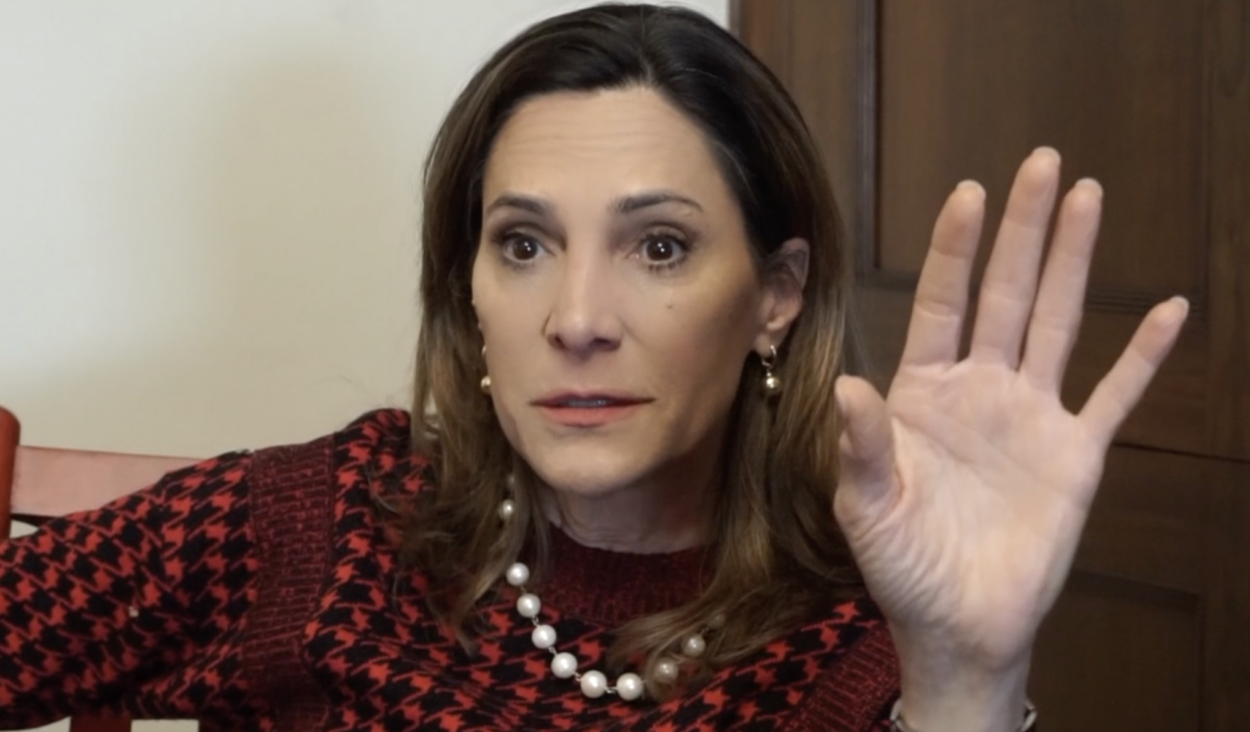

Maria Elvira Salazar

Rising housing prices have been a grave concern in Florida, and lawmakers are quickly moving to address it. Florida Rep. Maria Elvira Salazar (R) and Florida Senator Marco Rubio (R) have joined forces to introduce a bill that would lower housing prices.

The Home Advantage for American Families Act aims to protect American real estate markets from excessive foreign demand and the increase of affordable housing opportunities. If housing prices are lowered, it would ensure that illicit money cannot permeate the Miami housing market. As well, as outlined by a press release from Salazar’s office, the bill would invest “heavily in low-income and affordable housing initiatives to address the housing crisis in Miami.”

The bill would provide “an additional 10% of base-funding set-aside of the Low-Income Housing Tax Credit (LITHC) for single family home construction within Qualified Census Tracts (QCTs) to help states create more affordable housing opportunities that can accommodate a family.”

“Miami’s housing prices are out of control, and something needs to be done to address rising prices and expand access to affordable housing,” Salazar noted. Should the bill pass, Salazar explained that I would alleviate “our housing crisis by ensuring that Miami residents come first in the marketplace.”

Rubio echoed in Salazar’s remarks, further explaining how rising housing prices have affected the state.

“As billions of foreign dollars pour into Florida real estate, families in our communities are struggling to find affordable housing,” he shared, arguing that “to have a strong nation, we need strong communities. And to have strong communities, we must have strong families.”

As such, Rubio commented that “combating illicit finance in foreign real estate investment and increasing affordable housing investment in South Florida are key to tackling this problem confronting so many Floridians.”

Salazar’s press release further describes that the bill would authorize “the Treasury Department to issue reports for residential real estate transactions within the top fifteen Metropolitan Statistical Areas (MSAs) to identify the natural identities of foreign buyers. It also increases the Foreign Investment in Real Property Act (FIRPTA) of 1980 withholding tax on residential real estate to 30% for both foreign corporations and foreign individuals.”

The City of Miami is once again at the center of a controversy — this…

Representatives Darren Soto (D-FL) and Maria Elvira Salazar (R-FL) are reintroducing bipartisan legislation to protect…

As Floridians hit the road for the long Memorial Day weekend, they are going to…

Gov. Ron DeSantis signed a bill Thursday that will penalize Florida drivers for "excessively speeding"…

The May 27th deadline is fast approaching for Western oil companies to halt operations in…

Representative Brian Mast (R-FL) has introduced three pieces of legislation aimed at helping veterans and…