By Jose Mallea

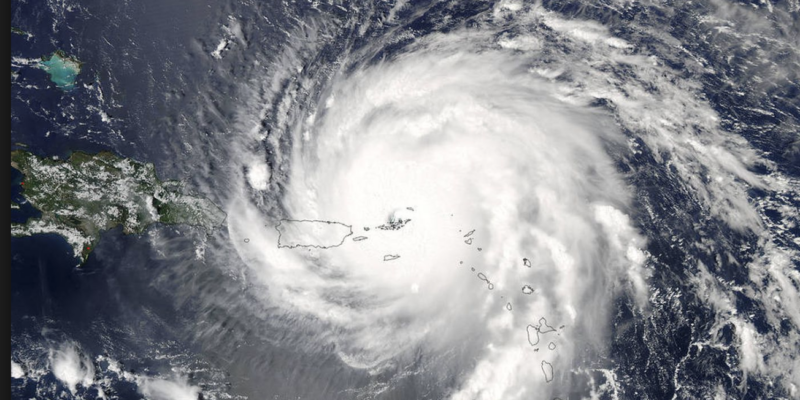

Now that hurricane season is upon us, we must be on the lookout for more than just the approaching storm. Anyone who has suffered damage to his or her property can become the target of unscrupulous scams involving dishonest contractors and their dodgy trial lawyer buddies. And we thought hurricanes were the destructive force!

In the 1917 landmark case, West Florida Grocery Co. v. Teutonia Fire Ins. Co., the Florida Supreme Court decided the insured could assign the benefits following a loss directly to a third party without the consent of the insurance provider. This precedent has lived on for over 100 years, still making it difficult for insurance companies to prohibit Assignment of Benefits (AOB) in Florida. Consumers are now caught in the middle as they’re torn between getting their home repaired and signing over insurance benefits.

Rising insurance prices and homeowner costs have reached an all-time high since 2010 due to unreasonable litigation claims. A study from the Florida Office of Insurance Regulation (FLOIR) shows that the average AOB claim was $17,000, 50 percent more than non-AOB claims. Additionally, the number of lawsuits from AOB increased from 408 in 2000 to over 28,000 in 2016.

Loopholes in the way AOB documents are being used have not only become quite prevalent, but incredibly harmful to consumers. Third party companies are now putting in claims to insurance companies that are higher than the actual damage value, which leads to excessive profits for these scammers. In some instances, claims are not even reported to the insurance company until the repairs have been completed, therefore not allowing the insurance company to inspect the damage. This ploy results in more additional profit for the contractor, which in turn, escalates severity and raises premiums for homeowners.

Changing the way AOBs are employed is vital to stopping this trend in insurance abuse. Without this correction, insurance premiums for homeowners will keep skyrocketing. We must keep the true intentions of AOB focused on reassigning the claims and repair process, which was created for homeowners to have a better customer experience. Unfortunately, as it stands now, insurers have lost control working with third party companies and this process is being exploited by scam contractors.

Our priority should be rebuilding a controlled system between homeowners, contractors and insurance companies through fair laws. We now face the challenge that Florida homeowners are unable to get claims payments, which results in a delayed process.

In 2017, Florida lawmakers faced heat for not addressing AOB reform at an appropriate time when consumers were facing out-of-control rate increases. According to Insurance Journal, this was the sixth year in a row that legislators did not address AOB abuse due to excessive lobbying by scammers to preserve the current broken system. Premiums are now projected to rise more than 60 percent over the next five years.

On top of contractors’ false claims and unnecessary litigation, we must shine light on Florida residents who are hampered in their decision-making process. Shouldn’t we be allowed a fair and organized arrangement to get our homes and cars repaired?

Just the other day, as I was pumping gas, a complete stranger came over to my car and claimed I needed a new windshield, and that he could take care of it at no cost to me. First of all, there was nothing wrong with my windshield. Secondly, if it sounds too good to be true, trust me, it’s a scam perpetrated by trial attorneys.

Shouldn’t we keep in mind that our goal is to protect residents through honest and fair laws? Instead, most in the industry worry about receiving and preventing large payouts, regardless of AOB abuse and the private insurance market. Although regulators are trying to prevent this abuse by communicating directly with consumers and creating content on how to file claims, there is still a lot of work that needs to get done.

Jose Mallea is President of the Biscayne Bay Brewing Company and ran for the Florida House of Representatives last year.