federal taxes

Representative Greg Steube (R-FL) has introduced legislation to lower capital gain taxes, a policy he said is "empowering investors to fuel economic growth and create good-paying American jobs." For a refresher, capital gains are when you sell an asset for more than what you bought it for. Assets can include stocks, bonds, and tangible items […]

By: Raeylee Barefield Latino business leaders, veterans, and working families are among the many urging the Senate to pass President Trump’s “One, Big, Beautiful Bill” (OBBB), a sweeping tax plan aimed at delivering major relief to working Americans. “Latinos–who historically supported President Trump’s America First Agenda in November–are counting on the Senate to pass The […]

Representative Sheila Cherfilus McCormick (D-FL) has introduced legislation to provide comprehensive tax relief to American families. Provisions within Rep. McCormick's All-Americans Tax Relief Act include new above-line deductions for medical, rent, daycare, commuting, and tutoring expenses, along with credit card debt interest for working and middle-class families. The Earned Income Tax Credit will also expand […]

Representative Greg Steube (R-FL) has introduced a bill protecting small businesses from undue tax burdens through gift and estate taxes. Specifically, Rep. Steube's Family Business Legacy Act updates a 2015 bill known as the Protecting Americans From Tax Hikes Act (PATH). The PATH Act itself was a response to the Internal Revenue Service (IRS) introducing […]

Representative Vern Buchanan (R-FL) introduced a bill increasing tax incentives for small businesses, encouraging growth and innovation. The most significant provision of Rep. Buchanan's American Innovation Act is increasing the amount of income small businesses can deduct from federal income taxes from $5,000 to $20,000, a massive tax break. Additionally, startup expenditure deductions, like advertising, […]

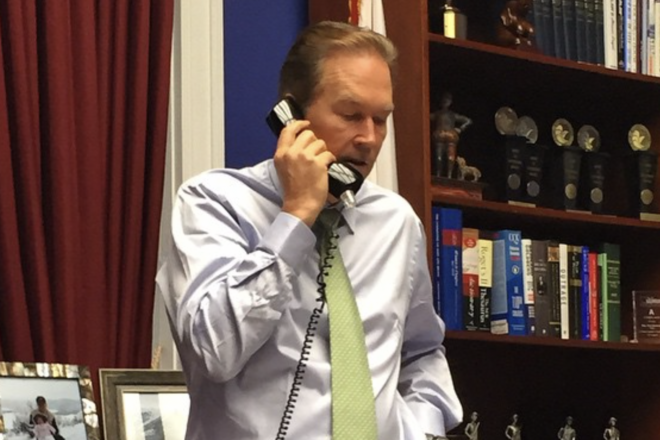

Representative Mike Haridopolos (R-FL) spoke with The Floridian to discuss tax policy, saying that extending the tax cuts from President Donald Trump's first term is crucial, as "the best thing we can do for the economy right now is offer certainty and stability." More to the point, he emphasized that "the longer we wait [to extend […]

Representatives Vern Buchanan (R-FL) and Byron Donalds (R-FL) have introduced new legislation removing taxes from income received through tips. Aptly named the "No Tax on Tips" Act, the bill allows for up to $25,000 in qualified tips to be deducted from income taxes and is reserved strictly for people working in traditionally tip-based jobs like […]

Social Security benefits are considered taxable income despite contributors paying into the system via payroll tax. Representative Cory Mills (R-FL) is cosponsoring a bill initially introduced by Representative Thomas Massie (R-KY) to remove the income tax from these benefits, saying on X (formerly Twitter), "We must return the American dream." Rep. Massie reintroduced the bill […]

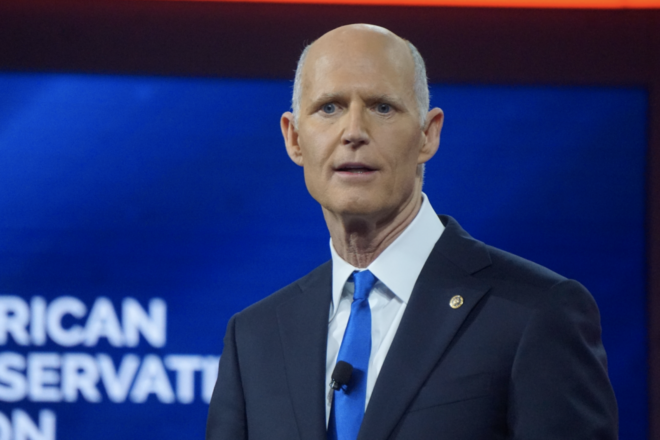

Vice President Kamala Harris has ignited derision among Republicans for her proposed tax policies should she retain the White House in November. Senator Rick Scott (R-FL) hit these policy proposals with both barrels during a recent appearance on Fox Business's Mornings with Maria, saying Harris "has no earthly idea what she is doing" and calling […]

With the Democratic National Convention ending, Vice President Kamala Harris has proposed a massive $5 trillion tax increase should she win the White House in November. Representative Mike Waltz (R-FL) discussed the proposals in a recent appearance on Fox Business's Bottom Line, calling them "Soviet-style, top-down overreach." Americans for Tax Reform provided host Dagen McDowell […]

As service industry workers know, tips and gratuities can significantly impact their livelihood. Former President Donald Trump's proposal to remove federal income taxes from tips, potentially boosting their earnings, has become a popular slogan. In a proactive response, Representatives Matt Gaetz (R-FL) and Thomas Massie (R-KY) are introducing the Tax-Free Tips Act. The bill exempts […]

"It is pro-jobs, pro-taxpayer, [and] pro-America." That is how Representative Aaron Bean (R-FL) described the Tax Relief for American Families and Workers Act in a recent speech on the House floor, which passed the House Wednesday night. Rep. Bean's brief remark did not leave out any criticism of President Biden's economy, saying it "has taken […]

People around the country are struggling in the current economy with inflation driving up prices. But a potential reprieve may come soon as the House Ways and Means Committee has overwhelmingly passed the Tax Relief for American Families and Workers Act at 40-3, with Representative Vern Buchanan (R-FL) being among those who voted in favor. […]

Rep. Vern Buchanans' recent introduction of the Tax Cuts and Jobs Act Permanency Act (TCJA) has drawn widespread support from House Republicans, including Rep. Brian Mast, who has publicly announced his support of the bill, tweeting that "Congressional Republicans and President Trump lowered taxes for every income bracket. It’s time to make those cuts permanent." […]

Rep. Vern Buchanan (R-FL) is pressing to make the cuts featured in the Tax Cuts and Jobs Act of 2017 permanent. Named the TCJA Permanency Act, the reintroduction of this bill receives support from 72 other Republicans in the House of Representatives, including nearly all of Florida's congressional delegation. "The biggest things about it," said […]

Without specifically mentioning his home state of Florida and Gov. Ron DeSantis, Sen. Rick Scott appeared on Fox News on Monday to reiterate his call for state governors to return all the non-COVID-related stimulus money that was recently appropriated in the $1.9 trillion funding law.