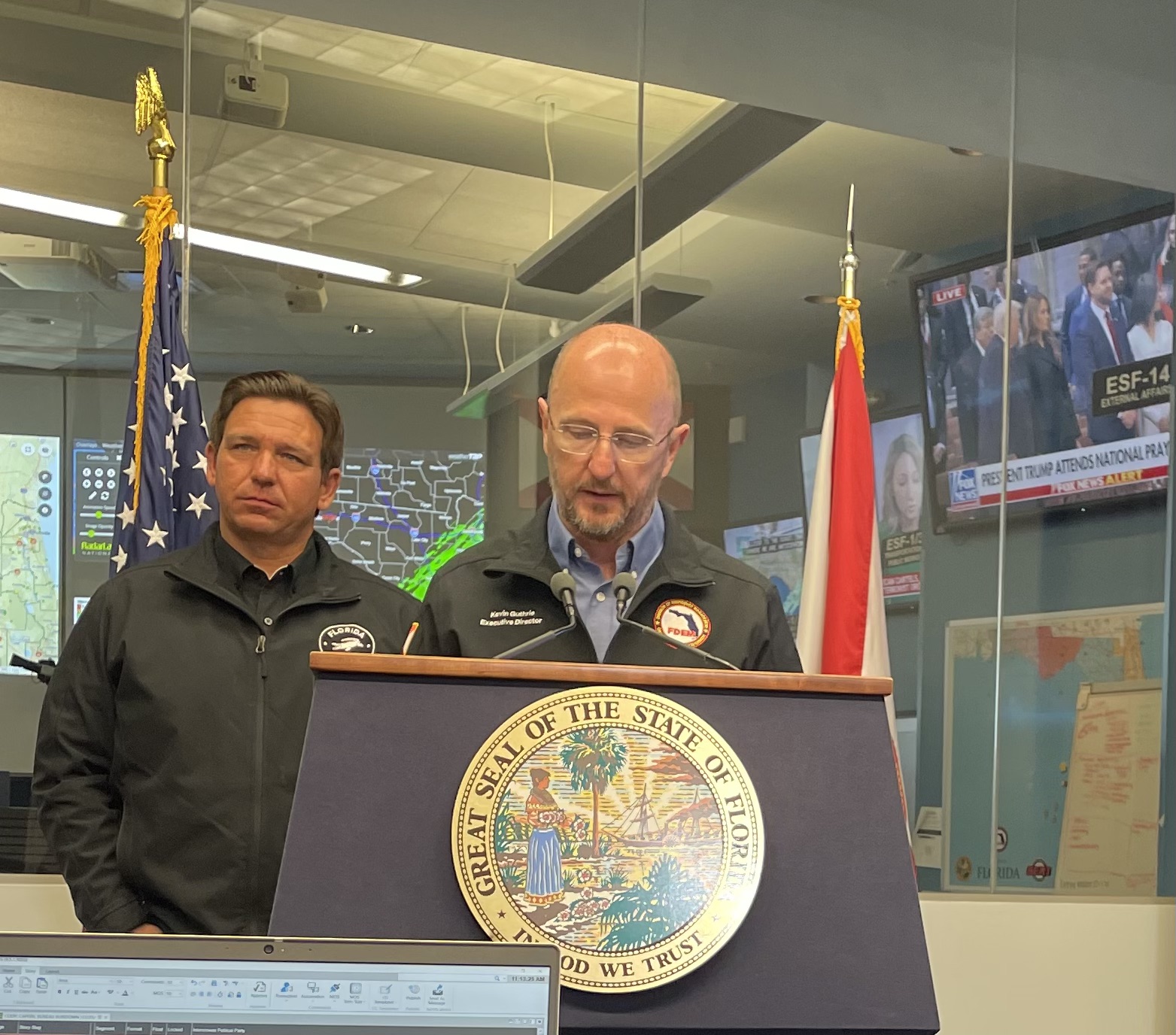

Gov. Ron DeSantis blasted "60 Minutes" as a "not credible" organization Monday afternoon after he was asked about the outlet's new investigation into Florida insurance companies that allegedly altered damage reports to pay homeowners less money.

Though he initially claimed he hadn't seen the segment, which aired Sunday night, Gov. DeSantis then said that Florida has protections in state law banning companies from altering adjusters' damage reports.

"I have a history with 60 minutes. They did a smear piece on me that was debunked—it was really embarrassing for them. So I am very, very much not a fan of them, and don't [see them as] credible," he said at a Bradenton press conference, referring to a 2021 "60 minutes" segment suggesting that he was wrapped up in a pay-for-play scheme with Publix grocery stores, who donated $100K to a DeSantis PAC.

No substantial evidence of a partnership between the state and Publix was provided.

"However, I will say this, if you're talking about the adjusters that do the report, we now have protections in Florida law that you can't just disregard what the adjuster does," he continued, pointing out that he signed a 2023 law banning insurers from altering an adjuster's damage report without a detailed explanation. This law was not, however, in place in the aftermath of Hurricane Ian—the subject of "60 Minutes'" newest segment.

According to five former adjusters who were either fired or resigned, various insurance companies in Florida altered their damage reports to pay policyholders a fraction of what the adjusters called for, "60 Minutes" reported. Even worse, they kept the adjuster's name on the report to make it seem like they had recommended that amount from the beginning.

For example, adjuster Jordan Lee believed that a South Florida family was owed upwards of $230K from Heritage Property and Casualty Insurance after their home was severely damaged by Ian. Heritage told the family they would just be getting $15k.

According to the segment, 44 of Lee's 46 damage reports during Hurricane Ian had been altered to give the policyholder less money, and all kept his name on the document. Some of his claims were driven down from $488K to $13K or $239K to $3K.

Heritage, for their part, told 60 Minutes they had no intention to deceive and has instituted "many reforms" that may be responsible for not putting the names of those who altered the damage reports onto the documents.

“Records show that some of [Lee’s] estimates were revised downward by his adjustment firm because he would include screen enclosures…that were not included in a homeowner’s policy,” they continued, swiping at Lee. “We are also aware of Jordan Lee being asked to collaborate by his employers at the third party adjustment firm and he would ignore that request for collaboration on his estimates.”

This comes at an increasingly awful time for Florida's insurance market, which saw a slew of national carriers fleeing the state after years of gold-plated storms sunk their way into people's homes and pockets. Since 2021, CBS reported, at least nine insurance companies have collapsed, while many of the remaining ones have taken to altering damage reports.

Combined with spiking premiums, the report spells out disaster for a state plagued with hurricanes and silver-tongued insurers.

"If they're identifying potential criminal activity, we have a Department of Justice in this country...Why not hold the wrongdoer accountable?" DeSantis said. "So if that's the case, then they should do it."