As the May 27 deadline approaches for U.S. and European energy companies to cease operations in Venezuela, Chinese firms are rushing to fill the vacuum in the oil-rich South American nation, significantly reshaping regional geopolitics and energy markets.

Chevron, Repsol, Eni, and Maurel & Prom must exit Venezuela by month's end following the U.S. Treasury Department's decision not to renew their licenses under the Trump administration's renewed "maximum pressure" approach toward the Maduro government. The decision affects not only U.S.-based Chevron but also Spain's Repsol, Italy's Eni, and France's Maurel & Prom, which together contribute approximately 325,000 barrels per day to Venezuela's oil production.

Analysts remain divided on the effectiveness of such measures. While proponents of "maximum pressure" sanctions argue they are necessary to force democratic reforms and curtail the Maduro regime's power, critics contend they have failed to achieve political change while exacerbating Venezuela's humanitarian crisis and benefiting U.S. adversaries like China, Russia, and Iran.

"In terms of production, it is not projected to fall significantly. Rather, it would fall slightly and stagnate, which is still a problem as Venezuela tries to recover economically from years of collapse," said Elias Ferrer of Orinoco Research in a statement to The Floridian.

With these energy companies exiting Venezuela, are Russia and China primed to co-opt or take control of the existing infrastructure?

"They certainly are, said Ferrer, adding that "the transfer will not happen straight away; it will take time."

"Chevron owns a percentage of the shares of four joint ventures, there is a long process to let go. But it can certainly happen," added Ferrer. "The main ExxonMobil operation in Venezuela back in the day is now controlled by a Russian state-owned firm—Petromost, which acts as a front for Rosneft."

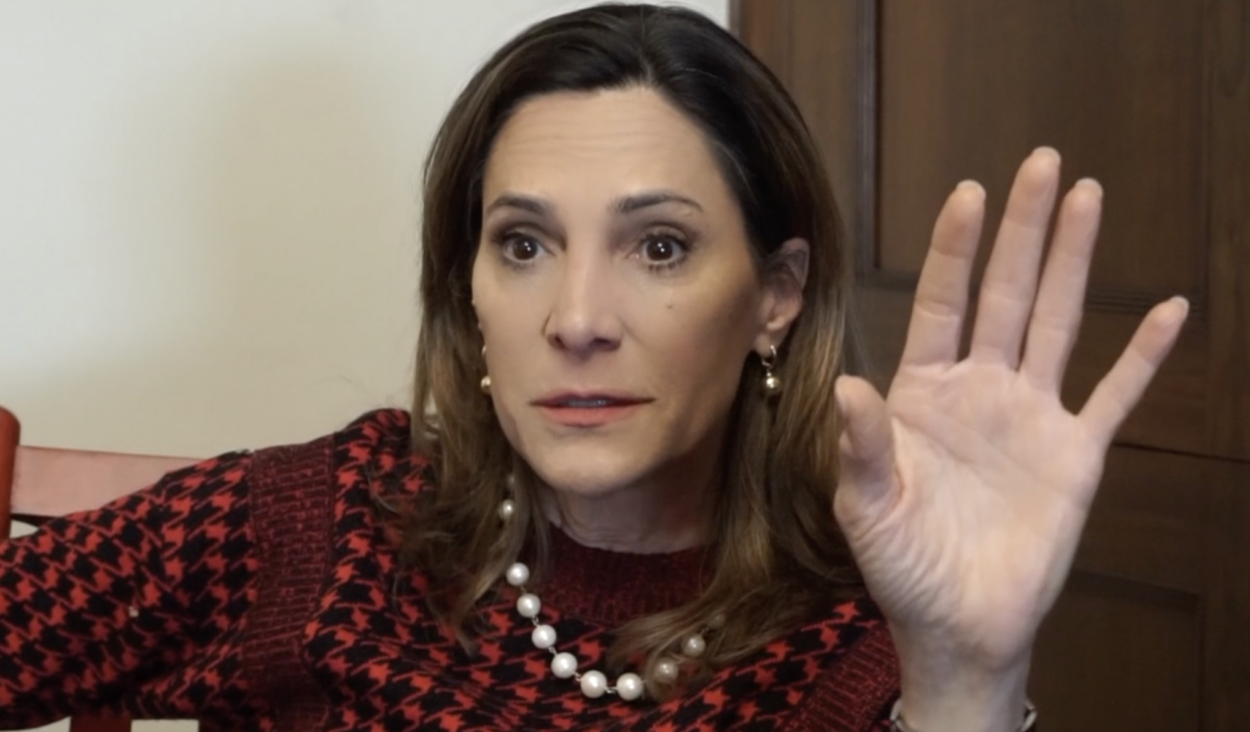

“While the intent behind these sanctions was to punish what many view as a corrupt and anti-democratic government, it is clear the ultimate consequences of this license revocation could undermine America’s strategic position in the global energy market, cede critical influence and power to China, and weaken our nation’s ability to secure affordable, reliable energy for the American people and initiate another migrant crisis at our borders,” said investigative journalist and political activist Laura Loomer in an “X” op-ed post. “Rather than America First, this policy shift signals a China First approach that should be avoided at all costs,” she added.

U.S. Treasury Secretary Scott Bessent acknowledged the complex considerations at play during his May 7 testimony before the House Committee on Financial Services. "It is a very acute balancing act there between displacing China with U.S. entities providing foreign currency to the Maduro regime," Bessent said.

Chinese Companies Secure Major Production Contracts

Chinese firms are wasting no time establishing their presence. According to documents reviewed by S&P Global Commodity Insights, Chinese companies Anhui Guangda Mining Investing Co. Ltd and China Concord Resources have signed three Production Participation Contracts (PPC) with Venezuela's state-owned oil company PDVSA under the country's Anti-Blockade Law.

"Economic blockades like this are usually ineffective in producing political change. In these countries, the U.S. has a negligible influence and the political opposition has been wiped out," added Ferrer.

Anhui, established in 2007, will develop the Ayacucho 2 block in the Orinoco Belt, targeting production of 121,000 barrels per day with a planned $6.1 billion investment. Meanwhile, China Concord Resources secured two contracts: one for the Lago Cinco area with a 50,000 b/d target and $631 million investment, and another for the LagunillasLago area aimed at producing 80,000 b/d with a $952 million investment.

These fields in Lake Maracaibo were previously reserved exclusively for PDVSA but have seen production decline to virtually zero.

Is the U.S. just spinning its energy wheels?

According to Ferrer, both Venezuela and China are ready to deal with situation.

"There are also reports that only 10% of China’s imports of Venezuelan oil are branded as such. The rest are branded as Brazilian, Singaporean or Malaysian, for example," said Ferrer. "We won’t see a large drop in Venezuelan oil exports, because we’ve been in this situation already. Both PDVSA, the state-owned oil company, and the black and grey market buyers, know how to deal with this situation."

European Oil Companies Also Affected

According to reports by Reuters and Venezuelanalysis, the European companies currently hold minority stakes in joint projects with Venezuela's state oil company PDVSA. Together, Repsol, Eni, and Maurel & Prom account for approximately 10 percent of Venezuela's present production.

Spain's Foreign Minister José Manuel Albares has pledged to defend Repsol's interests, while Eni has issued a statement promising "full compliance with international sanctions" while seeking options to continue natural gas distribution in Venezuela's domestic market. For its part, Maurel & Prom announced it was "assessing the implications with its legal advisers," with the company's shares falling by 15 percent following the announcement.

"We are in direct contact with the American authorities, and we are going to see if we are able to find mechanisms that may allow us to continue with our activity in this country," Repsol CEO Josu Jon Imaz stated at a business event in Madrid, according to media reports.

Boots on the Ground: Chinese Technical Personnel Already in Venezuela

Sources speaking on condition of anonymity revealed that approximately 30 Chinese technicians are already working both in the Eastern Lake Coast region and at the Cardon refinery in the Paraguana peninsula, Venezuela's second-most important refining facility.

"For Chinese companies, investing to repair a refinery that operates at less than 20% of its capacity is not business, but it changes when there is access to a secure and close oil production," said a high-level source at the Ministry of Hydrocarbons.

At the Cardon refinery, Venezuelan contractor Tecnifica is constructing a 19-module camp house 38 Chinese technicians. While specific details about repair plans remain limited, sources indicate the technicians are already working on the facility.

Sanctions Circumvention Intensifies

As U.S. companies prepare to exit, evidence suggests sanctions evasion tactics are becoming more sophisticated. Reuters reported this week that traders have rebranded over $1 billion worth of Venezuelan oil as Brazilian to bypass U.S. sanctions and reduce logistical costs.

This rebranding allows tankers to travel directly to China rather than using Malaysia as a transshipment hub, shortening delivery times significantly. Independent refineries in China, known as "teapots," are reportedly the main buyers of this disguised Venezuelan crude.

China currently stands as Venezuela's largest crude customer, with exports to China averaging 255,000 barrels per day in April, according to S&P Global Commodities at Sea data.

"These crackdowns will not make a dent into this line of business. Every year that passes by there are more sanctioned countries, and the world is more fragmented economically. So the sector outside the reach of the U.S. and EU just keeps growing," added Ferrer. "We have Iran, Venezuela, and now Russia on the list of sanctioned oil producers. That’s 15 million barrels of oil per day? Large economies like China and India are not missing out on this. About 3 billion people who need to import energy. To them, sanctions just mean discounts."

Iranian-Venezuelan Cooperation Deepens

Further complicating the geopolitical picture, Iran has expanded its partnership with Venezuela beyond the energy sector. Brigadier General Abdolreza Abed, commander of the IRGC's Khatam-al Anbiya Construction Headquarters, announced that Iran has signed a contract to build four 113,000-ton ships for Venezuela, with two vessels already delivered.

This deepening relationship between Venezuela and both China and Iran has raised concerns among U.S. analysts about increasing influence of American adversaries in the Western Hemisphere.

Is the U.S. conceding an energy advantage to the Communist Chinese Party (CCP)?

"For over a century, Chevron has been a cornerstone of American energy presence in Venezuela, a country sitting atop the world's largest proven oil reserves—some 300 billion barrels,” added Loomer, noting that in 2024 alone, "Venezuelan crude made up 13% of imports to U.S. Gulf Coast refineries, providing a vital supply of heavy crude to American refiners... which is simply unavailable in large, commercially viable quantities from US domestic oil producers."

According to economists and policy analysts, opinions on sanctions effectiveness remain divided. Venezuelan economist Francisco Rodríguez has noted that while Venezuela would have experienced economic crisis without sanctions, it wouldn't have been as severe, stating: "If it had not been for sanctions, Venezuela would have experienced a large economic crisis in the last decade, but it would have been more like other large economic crises in Latin America and even in prior Venezuela history. It wouldn't have been like what we've seen."

The Venezuelan, Maduro Response

For her part, Venezuelan Vice President and Hydrocarbons Minister Delcy Rodriguez took a defiant stance, stating, "If they want our oil, they will have to pay for it," in response to comments by U.S. Energy Secretary Chris Wright criticizing the Maduro government.

Rodriguez has also stated that Venezuela "maintains fluid communications with its foreign partners" and pledged to continue fulfilling existing contracts. In an official statement, she reiterated Caracas' call for foreign investment in its energy sector and emphasized that "international companies do not require authorization from any foreign government as the country does not recognize extraterritorial jurisdiction."

Oil tankers are already lining up in Lake Maracaibo, offering a stark visual of the imminent transition in Venezuela's oil sector.