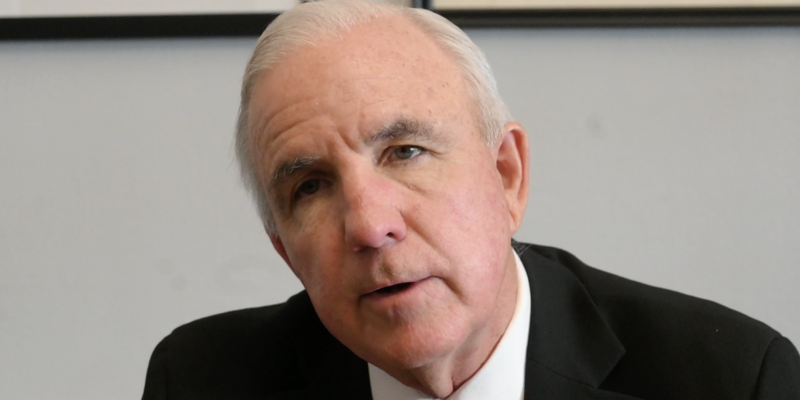

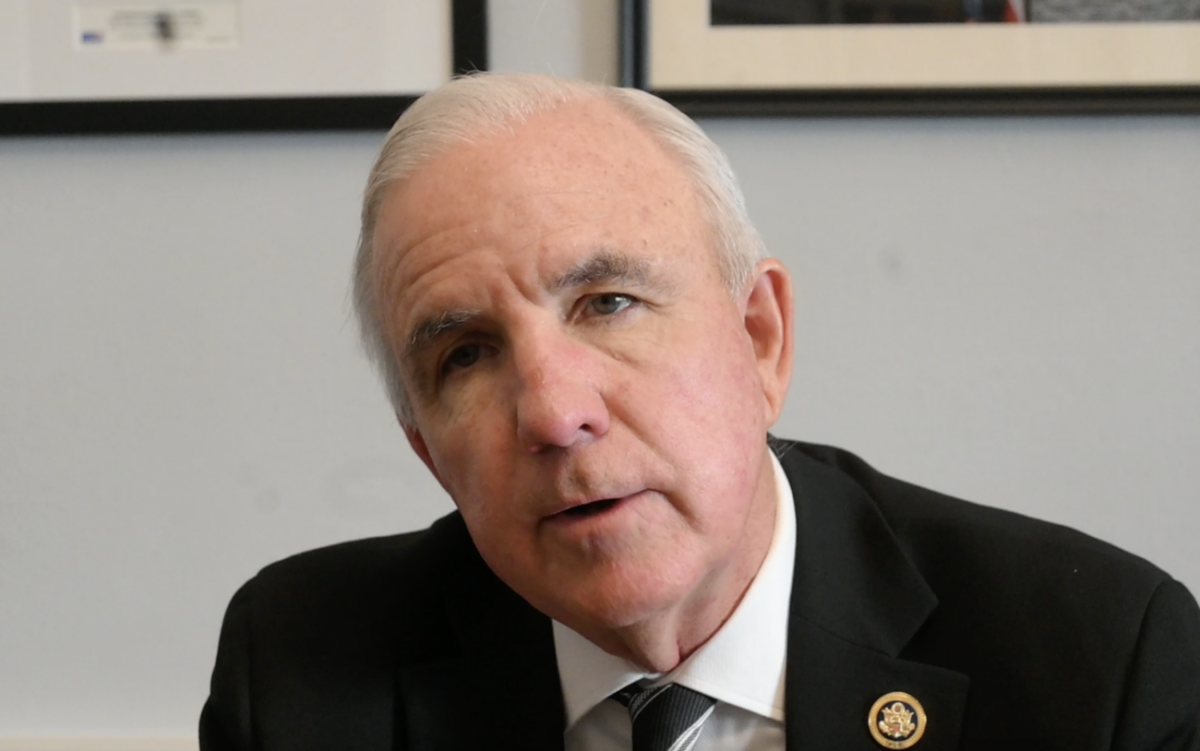

Coconut Grove, FL - Tax policy took center stage last night as the Economic Club of Miami hosted a timely discussion, "From Tariffs to Tax Cuts: What's next for the U.S. Economy." The event featured insights from Congressman Carlos Gimenez, with his remarks moderated by Kyle Pomerleau, a senior fellow at the American Enterprise Institute (AEI).

Amidst the elegant backdrop of Coconut Grove, the conversation centered on the pressing need for tax certainty, particularly for the nation's small businesses. Congressman Gimenez underscored the urgency of the situation, stating, "I think we are going to renew most if not all of [the Trump tax cuts]. If not, we will be saddled with perhaps the largest tax increase in American history.”

His comments come at a pivotal moment. Congress, wrapping up its Easter recess, is expected to return next week with the ambitious goal of crafting and passing a new tax bill through the reconciliation process. House Republicans are reportedly aiming to bring their reconciliation package to a vote within the next month, amplifying the ongoing debate surrounding the nation's pressing need to protect entrepreneurs and small businesses from economic uncertainty. President Trump is a big proponent of renewing these popular taxes enacted during his first Administration.

The core of the current debate revolves around the 2017 Tax Cuts and Jobs Act (TCJA). This landmark legislation brought about a reduction in average tax burdens across all groups and income brackets, and it temporarily streamlined the overbearing tax filing process. A key element of the TCJA was its significant impact on capital investment, achieved through a substantial decrease in the corporate tax rate – a change that has directly benefited Main Street businesses. This reform empowered smaller enterprises to reinvest in their operations and pursue growth opportunities with greater confidence. Other key provisions lawmakers would like to tackle are the R&D tax credit and bonus depreciation.

However, the clock is ticking. Several crucial provisions of the TCJA are slated to expire at the end of this year unless Congress takes decisive action. The ramifications of allowing these provisions to lapse are substantial, potentially leading to increased tax burdens for businesses of all sizes and potentially dampening economic activity.

As Congress reconvenes next week, the focus will undoubtedly intensify on crafting legislation that addresses these looming expirations. However, it looks like Rep. Gimenez is a proponent of these tax reductions and has Florida businesses and workers in mind. The coming weeks will be critical in shaping the trajectory of U.S. tax policy. The overarching imperative remains the implementation of policies that empower entrepreneurs, provide vital support to small businesses, and incentivize the investment and innovation that are indispensable for sustained economic prosperity across the nation.