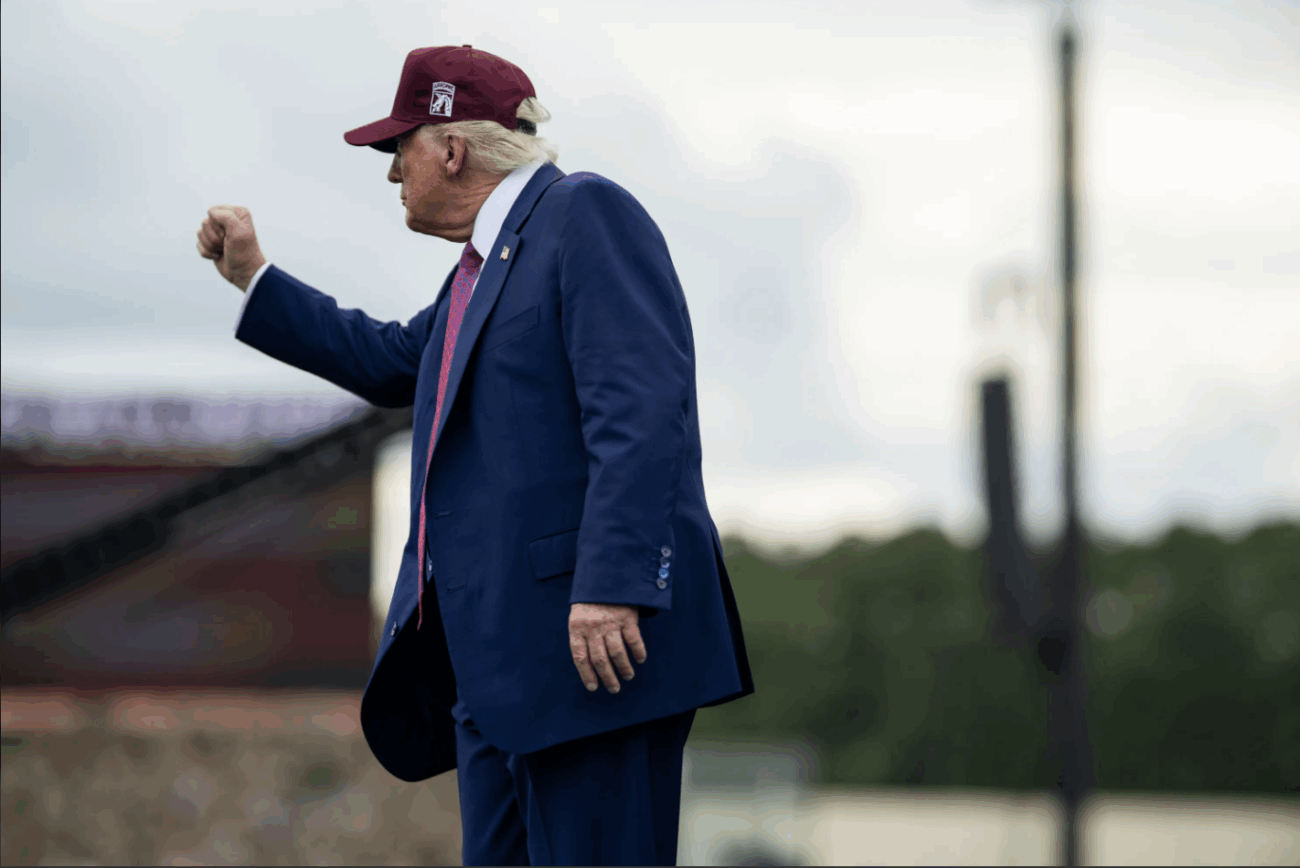

President-elect Donald Trump has vowed to block the sale of US Steel to Japanese steel manufacturer Nippon Steel Corporation (NSC).

NSC and US Steel closed the sale of the latter to the former on December 2023.

According to US Steel, NSC will pay $55.00 per share, representing an equity value of approximately $14.1 billion plus debt assumption, for a total enterprise value of $14.9 billion. NSC’s payment to US Steel represents a 40% increase to U. S. Steel’s closing stock price on December 15, 2023.

However, President Trump has opposed the sale, which is due to effectuate in the coming weeks and months.

“I am totally against the once great and powerful U.S. Steel being bought by a foreign company, in this case Nippon Steel of Japan,” said Trump. “Through a series of Tax Incentives and Tariffs, we will make U.S. Steel Strong and Great Again, and it will happen FAST! As President, I will block this deal from happening.”

During Trump’s first presidency, Section 232 tariffs on steel imports were imposed to preserve America’s domestic steel industry. Such tariffs, which remained in place and were even increased under President Joe Biden, would be inapplicable to NSC after it purchases US steel.

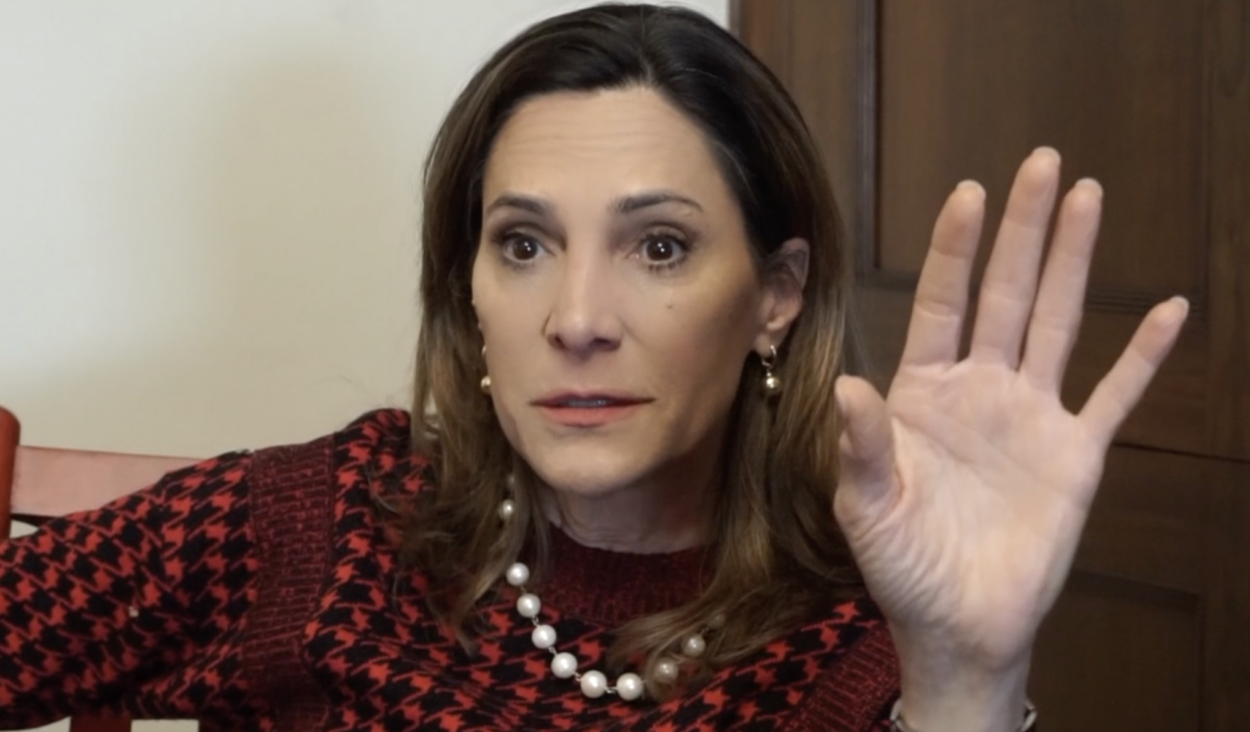

Conservative lawmakers, such as Trump’s secretary of state pick Marco Rubio, have similarly criticized the sale.

Rubio (R-Fl) wrote a letter to President Biden’s U.S. Treasury Secretary Janet Yellen urging her to prevent US Steel from being acquired soon after the sale was announced.

Conversely, US Steel executives have praised the move.

Chief Executive Officer of U. S. Steel, David B. Burritt, claimed he is “confident that, like our strategy, this combination is truly Best for All.” Decarbonization was among the factors encouraging the sale of US Steel to NSC.

CEO Burritt explained NSC’s “decarbonization focus is expected to enhance and accelerate our ability to provide customers with innovative steel solutions to meet sustainability goals.”