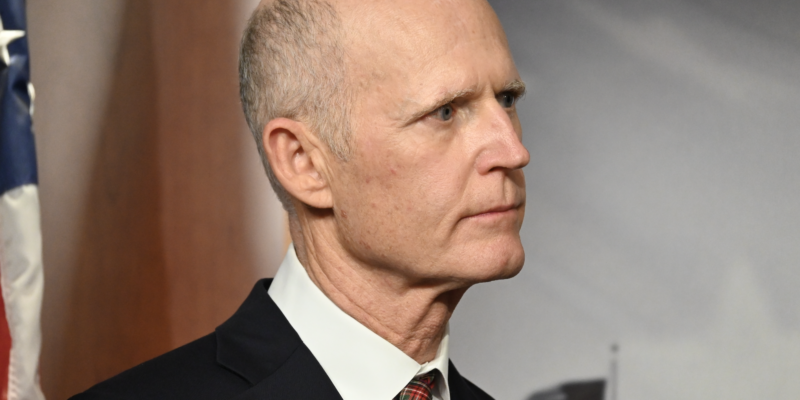

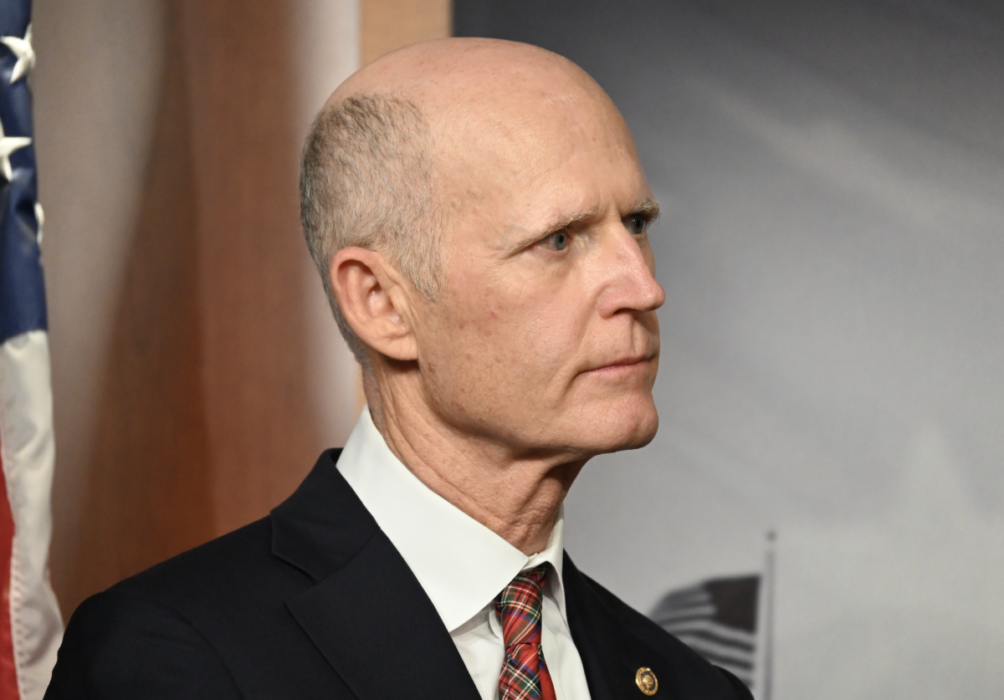

The Federal Reserve seems to continually demonstrate why Senator Rick Scott (R-FL) urges its reform. He and Senator Elizabeth Warren (D-MA) joined forces once more in a letter demanding better accountability practices from the Inspector General after reports indicated conflicts of interest are not adequately addressed and officials are let off easy for corruption.

Specifically, Sen. Scott and Sen. Warren pointed to the closure of investigations into former Dallas Federal Reserve Bank President Robert Kaplan and Boston Fed Bank President Eric Rosengren, who made investment trades with insider information in 2020.

Kaplan made multiple multi-million dollar trades in 2020 in over 12 companies, leaving two out of his Form A supplemental list. Rosengren similarly did not report trades, including 17 purchases of real estate trusts worth over $250,000 apiece, "at a time when he was "instrumental in policy decisions that influenced the nation’s housing market."

More egregiously, neither Kaplan nor Rosengren were recommended to face punishment despite two years of investigations. Similarly, a 2022 report did not charge Reserve Board Chair Jerome Powell or Vice Chair Richard Clarida for similar offenses.

"Your years-long delay before completing this investigation, your failure to hold Mr. Rosengren and Mr. Kaplan accountable for violating key Reserve Bank rules and policies, and your inability to address ongoing weaknesses in Federal Reserve ethics rules represent failures to uphold your mission of providing independent oversight of the agency," Sen. Scott and Sen. Warren wrote.

Hence, last March, the two introduced a bill making the Fed's Inspector General office presidentially appointed and confirmed by the Senate, because "This would ensure that the Federal Reserve IG is a truly independent watchdog enabled to provide accountability and transparency to the American people."

Later in July, Scott introduced several more bills designed to bring the Federal Reserve to heel, which included stricter oversight regulations, reducing the Fed's balance sheet to 10% of US GDP, and standardizing accounting regulations.

However, Scott seemed to ultimately seek the quickest solution: demand Fed Chair Jerome Powell's resignation, making the case in August and December.