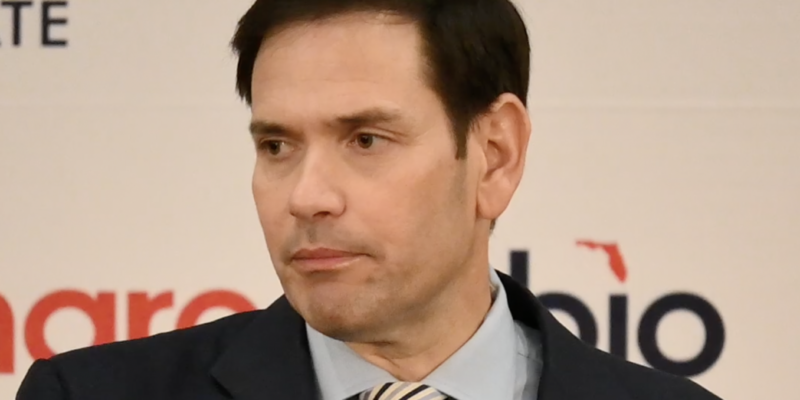

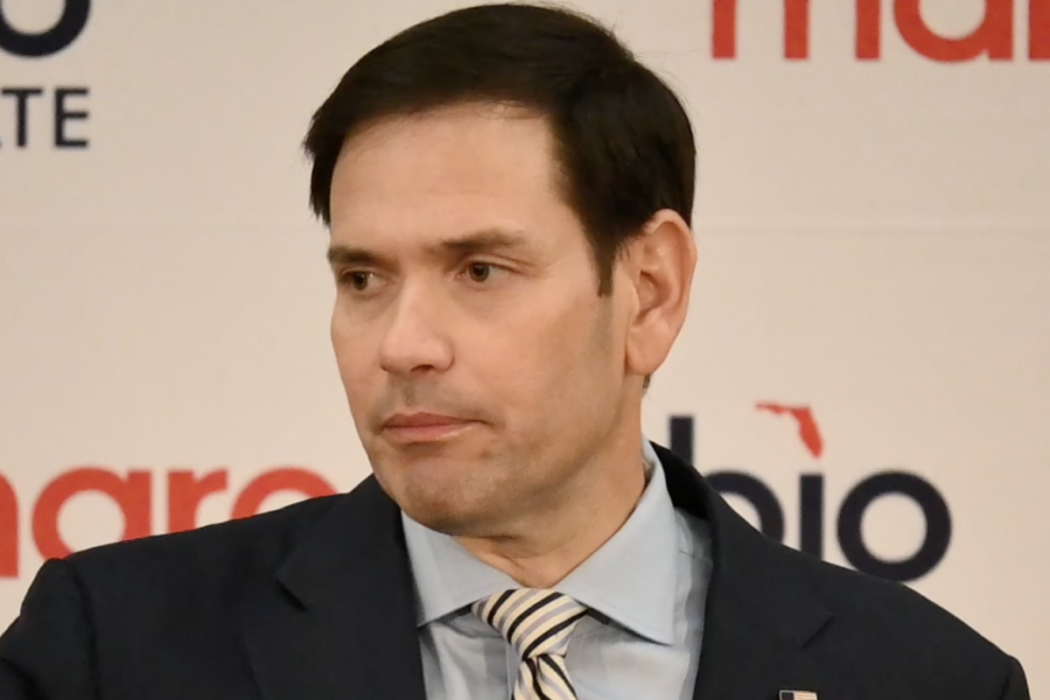

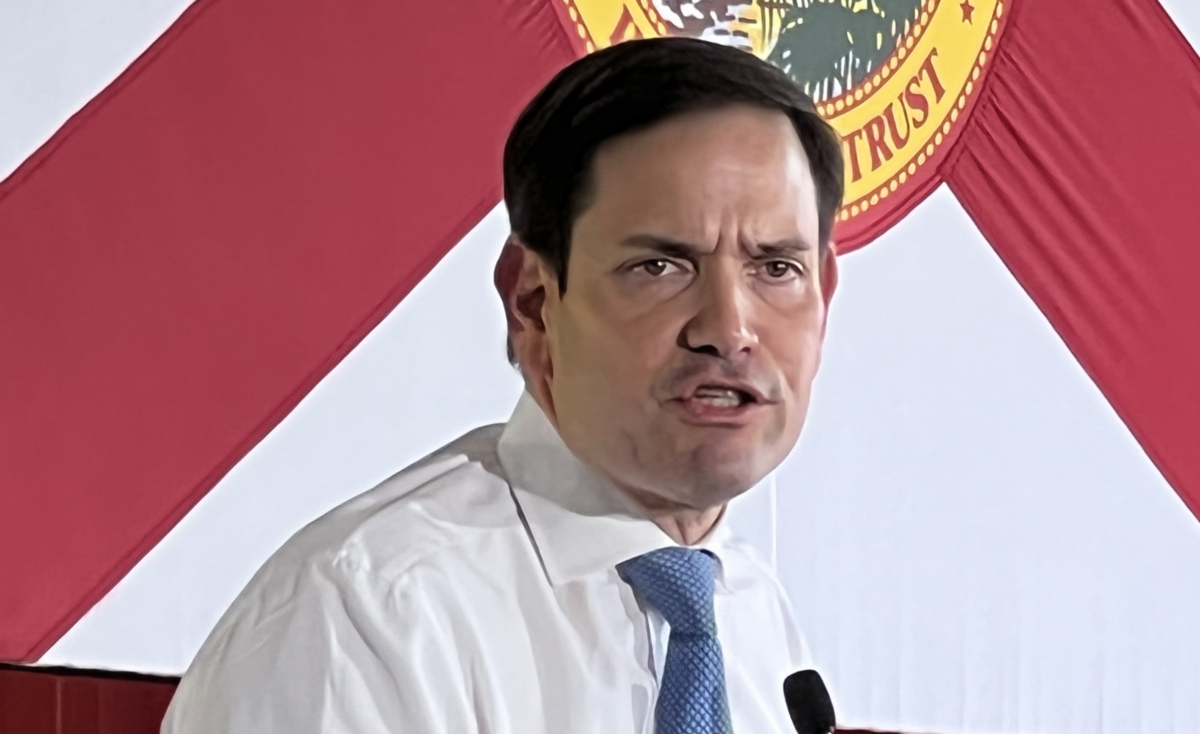

Chinese fast-fashion company Shein is attempting to gain access to the US stock market through an initial public offering (IPO). Due to alleged ties to the Chinese Communist Party (CCP) and the use of Uyghur forced labor, Senator Marco Rubio (R-FL) wrote a letter to Securities and Exchange Commissioner Gary Gensler demanding enhanced disclosures from Shein.

Shein first made an IPO at the end of November, which Sen. Rubio interpreted to mean, "This revelation makes virtually certain that the Chinese government will censor SHEIN’s filing documents to hide pertinent information from U.S. regulators and investors about the extent and nature of its operations in the PRC [People's Republic of China], as well as the risks of doing business in the PRC."

Additionally, Sen. Rubio pointed out that Shein approached the China Securities Regulatory Commission (CSRC) and Cyberspace Administration of China (CAC) to receive approval for the IPO, which in turn suggested: "SHEIN’s collaboration with Chinese regulators raises serious doubts that its IPO filings are complete and accurate."

As a result, Rubio demanded Gensler enhance disclosures from Shein, such as forcing them to acknowledge they are subject to China and that they used cotton harvested from Uyghur slave labor in violation of the Uyghur Forced Labor Prevention Act (UFPLA). Lastly, Shein has repeatedly exploited de minimis import laws, allowing them to dodge violations of the UFPLA.

"It is reasonable to ask whether any company so closely tied to an adversary nation should be able to raise funds in our capital markets, but as long as they are, transparent and exhaustive disclosures are the minimum price of admission," Rubio concluded.

In January, fellow Florida Senator Rick Scott (R) wrote to NASDAQ and the New York Stock Exchange with similar concerns about Shein's IPO, demanding they question Shein about usage of Uyghur slave cotton, de minimis law dodging, and assurance Shein would obey auditing and investing standards.

"These questions must be answered before moving forward with any listing on American financial exchanges," said Scott, adding, "Americans have already lost tens of billions of dollars on failed Chinese company IPOs in recent years, including Didi Global and Luckin Coffee. These frauds allow Communist China and their non-market economy to distort our free and open market, rob U.S. citizens of their savings, and give companies the benefits of access to U.S. markets without the responsibility of following the same laws as their competitors."