US Senator Marco Rubio (R-Fl) has written a letter to President Joe Biden’s U.S. Treasury Secretary Janet Yellen urging her to prevent US Steel Corporation (US Steel) from being acquired.

Earlier this week, US Steel announced Nippon Steel Corporation (NSC), a global steel manufacturer and Japan’s largest steelmaker, would be acquiring the company.

According to US Steel, NSC will pay $55.00 per share, representing an equity value of approximately $14.1 billion plus debt assumption, for a total enterprise value of $14.9 billion. NSC’s payment to US Steel represents a 40% increase to U. S. Steel’s closing stock price on December 15, 2023.

US Steel executives have praised the move.

Chief Executive Officer of U. S. Steel, David B. Burritt, claimed he is “confident that, like our strategy, this combination is truly Best for All.” Decarbonization was among the factors encouraging the sale of US Steel to NSC.

CEO Burritt explained NSC’s “decarbonization focus is expected to enhance and accelerate our ability to provide customers with innovative steel solutions to meet sustainability goals.”

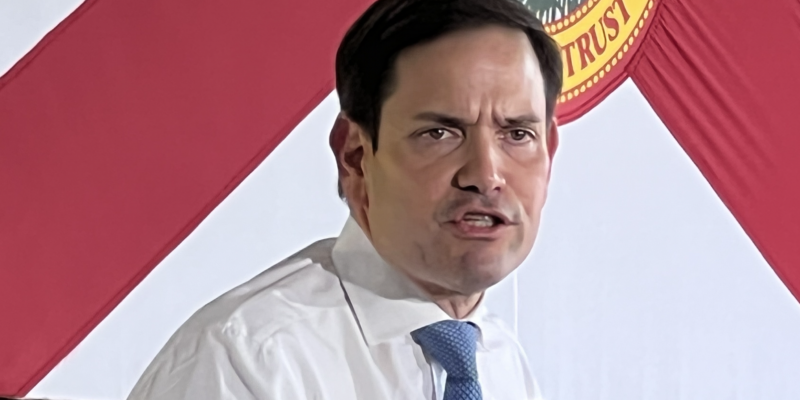

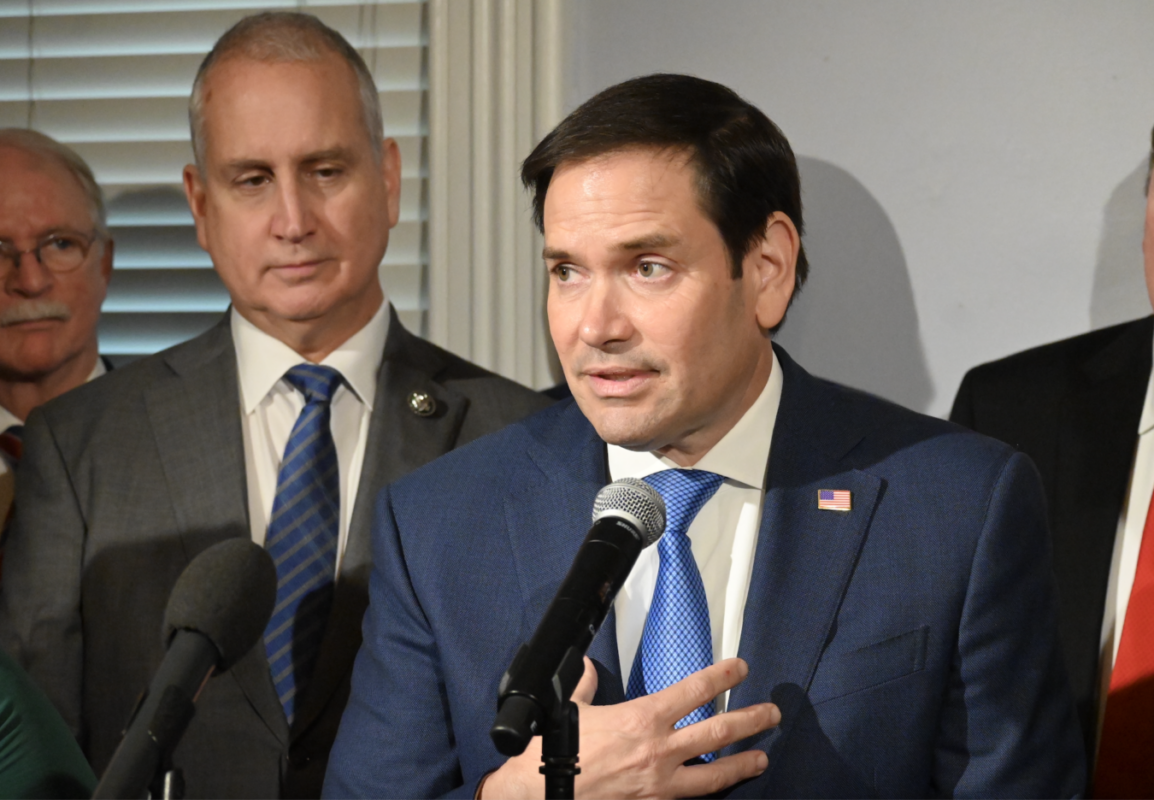

Yet Senator Rubio and several conservative lawmakers have criticized the decision to sell US Steel. Rubio claims the transaction was executed solely to benefit shareholders and failed to consider industry stakeholders and national security interests.

During President Donald Trump’s presidency, Section 232 tariffs on steel imports were imposed to preserve America’s domestic steel industry. According to Rubio, US Steel’s acquisition by a foreign company that has received billions in subsidies from the Japanese government undermines such tariffs.

Rubio and his Republican colleagues thus sent a letter to Secretary Yellen to prevent the transaction from occurring.

“Allowing foreign companies to buy out American companies and enjoy our trade protections subverts the very purpose for which those protections were put in place,” argued Rubio.

US Steel addressed domestic concerns regarding NSC’s acquisition of their company and claimed the sale benefits American stakeholders.

Burritt stated NSC’s acquisition of US Steel ensures “a competitive, domestic steel industry, while strengthening our presence globally.”

Unless Yellen intervenes, the transaction is expected to close in the second or third quarter of calendar year 2024.