Senator Marco Rubio (R-FL) sent a letter to the Treasury Secretary Janet Yellen to address the possibilities of the recent bank failures (Silicon Valley Bank – SVB – and Signature Bank) and their assets fallings into the hands of the Chinese Communist Party (CCP).

Those failed banks did not receive bailouts; however, depositors were guaranteed the funds that were in their account and were repaid in full before the two banks collapsed.

Jeanna Smialek and Alan Rappeport of The New York Times wrote that despite poor business practices of the bank, The Federal Reserve and the government as a whole was not going to penalize depositors.

“The actions were meant to send a message to America: There is no reason to pull your money out of the banking system, because your deposits are safe and funding is plentiful. The point was to avert a bank run that could tank the financial system and broader economy,” Smialek and Rappeport stated.

Moreover, Sen. Rubio has a different focus when it comes to the two banks and their collapse.

He has requested a review of the transactions of SVB and Signature Bank to ensure that assets of the institutions do not end up in the portfolios of the CCP.

“I ask the department to ensure that foreign adversarial regimes, as well as companies subject to their jurisdiction, are unable to exploit this moment for their own material benefit,” stated Rubio.

He would go on to mention that the Committee on Foreign Investment in the United States should be ready.

“I request that the Committee on Foreign Investment in the United States (CFIUS) be prepared to carefully review any covered transactions that result as a part of SVB’s, Signature Bank’s, and others’ potential closures, as well as secondary consequences that come about as a result of these closures. Beijing rarely allows an opportunity to exploit a crisis to pass by, so CFIUS must work diligently to ensure that promising American firms working in critical technologies do not end up acquired by Chinese conglomerates and others,” said Sen. Rubio.

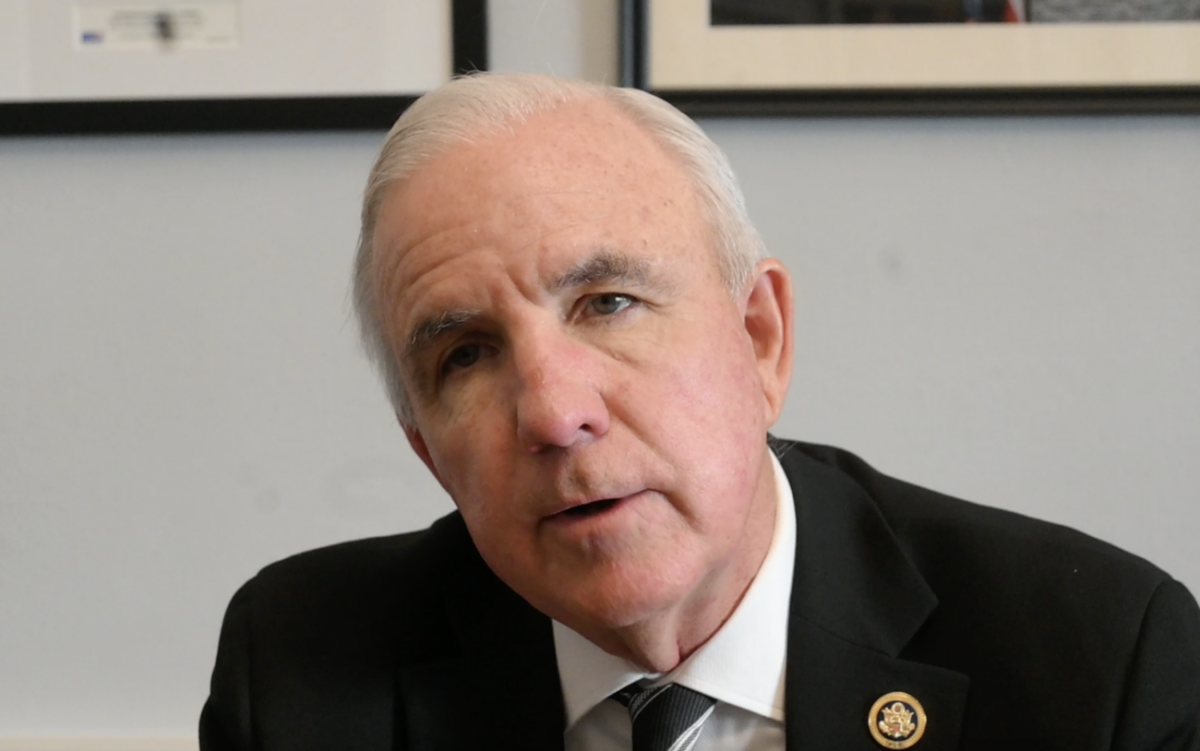

Earlier this week, Representative Cory Mills (R-FL) stated unequivocally that the taxpayers should not have to contribute to a bailout of the banks.

Not one dime of taxpayer money for bailouts. Plain and simple. We are here to serve the people.

— Rep. Cory Mills 🇺🇸 (@RepMillsPress) March 13, 2023

"Not one dime of taxpayer money for bailouts. Plain and simple. We are here to serve the people," stated Rep. Mills.

This is a developing story.