In an effort to be more transparent with the American people and to secure confidence in their investments, Sen. Rick Scott (R-FL) and Sen. Chris Van Hollen (D-MD) have both reached across the aisle to introduce the Trading and Investing with Clear Knowledge and Expectations about Risk (TICKER) Act. The bill is designed so that the Securities and Exchange Commission (SEC) has to make recommendations about possible risky investments in Variable Interest Entities (VIE), especially if those entities are connected to China.

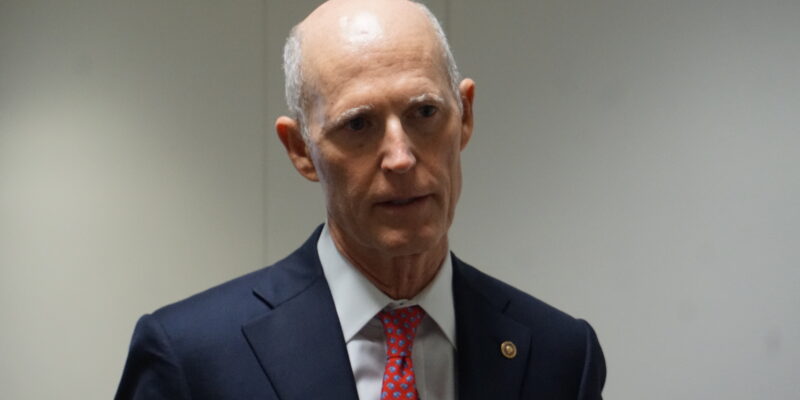

“Every day, American investors unknowingly invest their hard-earned dollars in entities linked to, owned or controlled by the Communist Chinese regime,” said Senator Scott. “These investments carry enormous risks and could result in massive but completely preventable losses. Passing the TICKER Act will ensure that the Securities and Exchange Commission (SEC) uses its resources and authority to protect both U.S. investors and American financial markets, and creates greater transparency regarding the grave risks posed by entities linked to Communist China.”

Within 180 days, the bill requires the SEC to let investors know the high risk for companies that are on U.S. stock exchanges and requires warning labels on those stocks that are at-risk.

“Following the passage of my Holding Foreign Companies Accountable Act, the SEC is already taking action to help ensure Chinese companies operating on US markets are held to the same standards as other foreign companies, in order to better protect American investors,” said Senator Van Hollen. “This legislation will go a step further by ensuring investors are aware of particularly risky foreign companies that leave investors without any legal recourse or direct ownership interests, and ensure they have the tools necessary to make informed decisions about their holdings.”

In past, Rick Scott has been very stern on foreign nations and their interactions with our economy, especially concerning Chinese and Russian affairs.